Section Four

Enterprise in focus

92%

of enterprise TA leaders plan to invest in additional tech to increase hiring efficiency in 2026.

92%

of enterprise TA leaders plan to invest in additional tech to increase hiring efficiency in 2026.

Executive summary

Enterprise hiring teams entered 2026 facing sustained pressure, and little margin for error. Despite having broader access to technology, data, and AI than smaller organizations, large employers continue to struggle with execution at scale.

TA leaders at large-scale organizations operate in an environment where small inefficiencies compound quickly. Scheduling complexity, interviewer availability, layered decision-making, and fragmented communication don’t just slow hiring—they destabilize it. As a result, enterprise teams feel the impact of rising time-to-hire, candidate drop-off, and recruiter workload more acutely than most.

At the same time, the enterprise risk profile is changing. Candidate fraud and misrepresentation are emerging as serious concerns, while candidate expectations for speed, flexibility, and transparency continue to rise. In this environment, process discipline matters as much as talent strategy.

The data shows a growing divide among enterprise organizations. Teams that standardize workflows, modernize scheduling, centralize communication, and deploy AI as hiring infrastructure (not just automation) are better positioned to keep pace. Those that rely on manual coordination and fragmented systems are falling further behind.

TA leaders at large-scale organizations operate in an environment where small inefficiencies compound quickly. Scheduling complexity, interviewer availability, layered decision-making, and fragmented communication don’t just slow hiring—they destabilize it. As a result, enterprise teams feel the impact of rising time-to-hire, candidate drop-off, and recruiter workload more acutely than most.

At the same time, the enterprise risk profile is changing. Candidate fraud and misrepresentation are emerging as serious concerns, while candidate expectations for speed, flexibility, and transparency continue to rise. In this environment, process discipline matters as much as talent strategy.

The data shows a growing divide among enterprise organizations. Teams that standardize workflows, modernize scheduling, centralize communication, and deploy AI as hiring infrastructure (not just automation) are better positioned to keep pace. Those that rely on manual coordination and fragmented systems are falling further behind.

Enterprise snapshot

Hiring goal attainment remains challenging for large organizations

Time-to-hire continues to worsen for most enterprise teams

Scheduling is the dominant operational bottleneck at scale

AI adoption is widespread, but impact depends on usage

2026 priorities center on efficiency, tech modernization, and workflow standardization

Challenges and bottlenecks at enterprise scale

Enterprise hiring teams face many of the same challenges as the broader market—but scale magnifies their impact.

The data shows that enterprise strain is driven first by workload and volume, not a single talent constraint. Retaining top talent and unmanageable recruiter workload are the most cited challenges, highlighting how difficult it has become for large teams to sustain performance under constant hiring pressure. An overwhelming number of applicants and limitations of current hiring technology follow closely, signaling systems that are struggling to keep up with demand.

Execution challenges further compound the issue. Candidates with multiple offers, insufficiently trained hiring managers and interviewers, and new-hire no-shows all rank among the top enterprise obstacles—pointing to breakdowns in consistency and follow-through at scale.

Skills misalignment and candidate drop-off remain persistent concerns, particularly as fraudulent resumes created with AI make it harder to assess true capability across high-volume pipelines. The appearance of fake or fraudulent candidates among the top challenges adds yet another layer of risk for already overextended enterprise teams.

Taken together, the picture is clear: enterprise hiring challenges are systemic and operational, driven by volume, workload, and execution strain rather than talent scarcity alone.

The data shows that enterprise strain is driven first by workload and volume, not a single talent constraint. Retaining top talent and unmanageable recruiter workload are the most cited challenges, highlighting how difficult it has become for large teams to sustain performance under constant hiring pressure. An overwhelming number of applicants and limitations of current hiring technology follow closely, signaling systems that are struggling to keep up with demand.

Execution challenges further compound the issue. Candidates with multiple offers, insufficiently trained hiring managers and interviewers, and new-hire no-shows all rank among the top enterprise obstacles—pointing to breakdowns in consistency and follow-through at scale.

Skills misalignment and candidate drop-off remain persistent concerns, particularly as fraudulent resumes created with AI make it harder to assess true capability across high-volume pipelines. The appearance of fake or fraudulent candidates among the top challenges adds yet another layer of risk for already overextended enterprise teams.

Taken together, the picture is clear: enterprise hiring challenges are systemic and operational, driven by volume, workload, and execution strain rather than talent scarcity alone.

“The reality is that, in the age of AI, the resume and application is going to give significantly less signal on a candidate’s capability. That means putting more weight on work-sample–style assessments, scenario walkthroughs, and live problem-solving that reveals how someone thinks, not how well they can prompt AI.”

Becky McCullough

VP, Talent Acquisition & Mobility, HubSpot

Time-to-hire trends: scale compounds delay

Time-to-hire remains one of the most pressing issues for enterprise TA teams.

A majority of enterprise leaders report that time-to-hire increased over the past year, while only a small minority managed to reduce it. While this trend mirrors the broader market, its consequences are amplified at enterprise scale—where slow hiring directly impacts productivity, revenue, and workforce planning.

Complex approval structures, interviewer scarcity, and manual scheduling workflows all contribute to longer cycles. As timelines stretch, enterprise teams face higher candidate drop-off rates and increased competition from faster-moving employers.

The takeaway is clear: enterprise hiring speed is constrained by systems, not effort. Without structural fixes, incremental changes will not reverse the trend.

A majority of enterprise leaders report that time-to-hire increased over the past year, while only a small minority managed to reduce it. While this trend mirrors the broader market, its consequences are amplified at enterprise scale—where slow hiring directly impacts productivity, revenue, and workforce planning.

Complex approval structures, interviewer scarcity, and manual scheduling workflows all contribute to longer cycles. As timelines stretch, enterprise teams face higher candidate drop-off rates and increased competition from faster-moving employers.

The takeaway is clear: enterprise hiring speed is constrained by systems, not effort. Without structural fixes, incremental changes will not reverse the trend.

Candidate experience pressures intensify

Enterprise leaders report that the hiring landscape has become more demanding, more competitive, and more operationally complex over the past year.

The most widely felt change is recruitment team turnover, with enterprise leaders citing its impact on their ability to manage candidate flow. At the same time, growing candidate demands have increased the number of touchpoints required throughout the hiring process, making consistency harder to maintain at scale.

Relationship-building has also taken on greater importance. Enterprise leaders increasingly emphasize the need to create meaningful connections with candidates and to connect faster, as slow or fragmented engagement raises the risk of losing candidates to competing employers. Competition remains intense, with many leaders reporting increased demand for talent. At the same time, others note growing talent availability, illustrating a fragmented market where volume may increase, but speed and clarity still determine outcomes.

Finally, a rising candidate drop-off rate reinforces the stakes. As processes grow longer or less transparent, candidates disengage more quickly, putting additional pressure on already stretched enterprise teams.

Taken together, the data shows that enterprise candidate experience is now defined by execution under pressure. Managing candidate flow, maintaining engagement across more touchpoints, and moving quickly have become essential to competing at scale.

The most widely felt change is recruitment team turnover, with enterprise leaders citing its impact on their ability to manage candidate flow. At the same time, growing candidate demands have increased the number of touchpoints required throughout the hiring process, making consistency harder to maintain at scale.

Relationship-building has also taken on greater importance. Enterprise leaders increasingly emphasize the need to create meaningful connections with candidates and to connect faster, as slow or fragmented engagement raises the risk of losing candidates to competing employers. Competition remains intense, with many leaders reporting increased demand for talent. At the same time, others note growing talent availability, illustrating a fragmented market where volume may increase, but speed and clarity still determine outcomes.

Finally, a rising candidate drop-off rate reinforces the stakes. As processes grow longer or less transparent, candidates disengage more quickly, putting additional pressure on already stretched enterprise teams.

Taken together, the data shows that enterprise candidate experience is now defined by execution under pressure. Managing candidate flow, maintaining engagement across more touchpoints, and moving quickly have become essential to competing at scale.

AI and automation adoption: ubiquitous, but uneven

AI and automation are widely used across enterprise TA teams, but adoption is uneven by task.

Analytics and reporting lead all enterprise AI use cases, followed by writing job descriptions and interview scheduling. These top applications reflect where enterprise teams are seeing the most immediate value: visibility into hiring performance and relief from high-friction, repeatable work.

Adoption drops off across more candidate-facing and judgment-heavy tasks. Conversational AI, resume screening, candidate sourcing, and drafting candidate communications are used by fewer teams, suggesting a more cautious approach to automating direct candidate interaction.

Overall, the data shows that enterprise teams are applying AI broadly—but prioritizing internal efficiency and insight over front-of-funnel automation

Analytics and reporting lead all enterprise AI use cases, followed by writing job descriptions and interview scheduling. These top applications reflect where enterprise teams are seeing the most immediate value: visibility into hiring performance and relief from high-friction, repeatable work.

Adoption drops off across more candidate-facing and judgment-heavy tasks. Conversational AI, resume screening, candidate sourcing, and drafting candidate communications are used by fewer teams, suggesting a more cautious approach to automating direct candidate interaction.

Overall, the data shows that enterprise teams are applying AI broadly—but prioritizing internal efficiency and insight over front-of-funnel automation

Scheduling presents the biggest opportunity for improvement

Scheduling remains the single largest operational burden in enterprise hiring.

Across the market, recruiters spend a substantial share of their time coordinating interviews. For enterprise teams, this burden is intensified by:

Across the market, recruiters spend a substantial share of their time coordinating interviews. For enterprise teams, this burden is intensified by:

- Larger interviewer pools

- Cross-functional scheduling dependencies

- Higher frequency of cancellations and reschedules

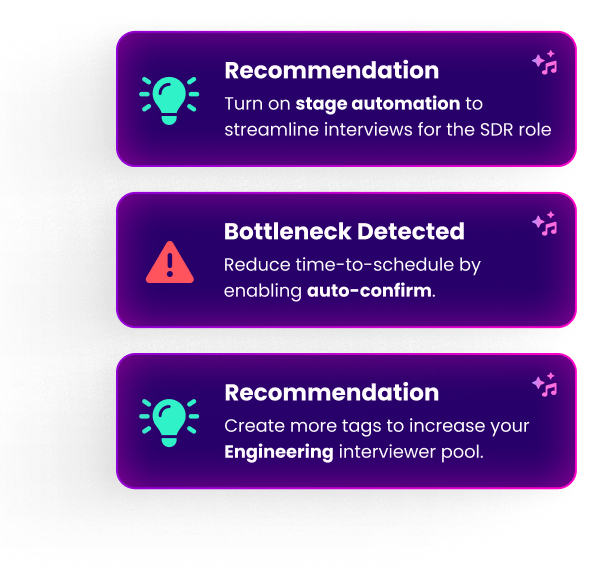

Get proactive recommendations that improve hiring speed, consistency, and flow.

GoodTime's AI flags bottlenecks, suggests optimizations, and highlights steps that slow your team down. You get clear guidance on how to accelerate scheduling and improve efficiency at every stage.

Learn more

2026 outlook: expected disruptors for enterprise teams

Enterprise TA leaders expect disruption in 2026 to be driven primarily by execution and evaluation challenges, not sourcing alone.

The most anticipated issue is inefficient or untrained hiring managers and interviewers, cited more often than any other disruptor. This points to growing strain on interview quality, interviewer readiness, and decision consistency at enterprise scale.

Close behind is candidate fraud, including AI-generated or misrepresented qualifications. For large organizations with high hiring volume, this introduces new complexity into screening and verification and raises both operational and reputational risk.

Several additional disruptors cluster closely together, including unrealistic compensation expectations, unmanageable recruiter workload, and changes in company hiring policies. These pressures reflect both external market dynamics and internal complexity that enterprise teams must navigate simultaneously.

Notably, traditional concerns like lack of qualified candidates and technology limitations remain present but rank lower than people- and process-related challenges. Candidate drop-off and difficulties adapting interview processes also persist, reinforcing how fragile execution becomes as systems scale.

Overall, the chart shows that enterprise hiring risk in 2026 is less about access to talent and more about managing people, process, and signal quality under pressure.

The most anticipated issue is inefficient or untrained hiring managers and interviewers, cited more often than any other disruptor. This points to growing strain on interview quality, interviewer readiness, and decision consistency at enterprise scale.

Close behind is candidate fraud, including AI-generated or misrepresented qualifications. For large organizations with high hiring volume, this introduces new complexity into screening and verification and raises both operational and reputational risk.

Several additional disruptors cluster closely together, including unrealistic compensation expectations, unmanageable recruiter workload, and changes in company hiring policies. These pressures reflect both external market dynamics and internal complexity that enterprise teams must navigate simultaneously.

Notably, traditional concerns like lack of qualified candidates and technology limitations remain present but rank lower than people- and process-related challenges. Candidate drop-off and difficulties adapting interview processes also persist, reinforcing how fragile execution becomes as systems scale.

Overall, the chart shows that enterprise hiring risk in 2026 is less about access to talent and more about managing people, process, and signal quality under pressure.

2026 priorities and tech investment plans

Enterprise hiring priorities for 2026 are tightly centered on execution and efficiency.

The top focus areas reflect a clear desire to make hiring systems work better at scale. Optimizing automation and improving overall efficiency lead all priorities, followed closely by reducing time-to-hire and improving the candidate experience. Together, these signals point to enterprise teams working to remove friction from core workflows rather than adding new layers of process.

Just behind those top priorities, enterprise leaders cite using AI to make hiring more efficient, upgrading hiring technology, and increasing offer acceptance rates—reinforcing that technology investment is expected to directly support speed, coordination, and follow-through. Standardizing hiring processes and reducing time-to-schedule also rank highly, highlighting the importance of consistency across teams and regions.

Lower on the list are relationship-building and personalization efforts, suggesting that in 2026, enterprise teams are prioritizing reliability and execution over bespoke experiences.

The top focus areas reflect a clear desire to make hiring systems work better at scale. Optimizing automation and improving overall efficiency lead all priorities, followed closely by reducing time-to-hire and improving the candidate experience. Together, these signals point to enterprise teams working to remove friction from core workflows rather than adding new layers of process.

Just behind those top priorities, enterprise leaders cite using AI to make hiring more efficient, upgrading hiring technology, and increasing offer acceptance rates—reinforcing that technology investment is expected to directly support speed, coordination, and follow-through. Standardizing hiring processes and reducing time-to-schedule also rank highly, highlighting the importance of consistency across teams and regions.

Lower on the list are relationship-building and personalization efforts, suggesting that in 2026, enterprise teams are prioritizing reliability and execution over bespoke experiences.

Nearly all enterprise TA leaders say they are likely or very likely to invest in additional hiring technology in 2026, with very few expressing uncertainty or resistance. This confirms that modernization is not optional at enterprise scale.

At the same time, the priorities data makes one thing clear: technology alone is not the goal. Enterprise teams are investing in tech as a means to improve efficiency, speed, and consistency—especially where manual work and coordination strain have become unsustainable.

At the same time, the priorities data makes one thing clear: technology alone is not the goal. Enterprise teams are investing in tech as a means to improve efficiency, speed, and consistency—especially where manual work and coordination strain have become unsustainable.

Enterprise hiring in 2026: Execution is the strategy

Enterprise hiring in 2026 demands operational resilience.

The organizations best positioned to succeed are not those with the most tools, but those with the most disciplined systems. By modernizing scheduling, centralizing communication, and deploying AI as infrastructure rather than experimentation, enterprise TA teams can regain speed, reduce risk, and restore confidence in their hiring engine.

At enterprise scale, execution is strategy. The teams that fix the mechanics of hiring will be the ones that can withstand pressure—and hire with confidence—in the year ahead.

The organizations best positioned to succeed are not those with the most tools, but those with the most disciplined systems. By modernizing scheduling, centralizing communication, and deploying AI as infrastructure rather than experimentation, enterprise TA teams can regain speed, reduce risk, and restore confidence in their hiring engine.

At enterprise scale, execution is strategy. The teams that fix the mechanics of hiring will be the ones that can withstand pressure—and hire with confidence—in the year ahead.

Copyright © 2026. Built with ❤️ all over the world.