2026

Hiring

Insights

Report

Financial Services

How 100+ Financial Services TA leaders redefine hiring with AI and innovation

Executive summary

Time-to-hire continues to worsen for most organizations, driven by fragile coordination in the middle of the funnel. Scheduling delays, inconsistent interviewer readiness, and slow decision cycles compound quickly in a sector where candidates often juggle multiple offers and prolonged timelines increase both drop-off and compliance risk. Even with better goal attainment, execution speed has not stabilized—leaving recent gains exposed.

At the same time, the threat landscape is shifting. Fraudulent or AI-assisted candidate misrepresentation has become a material concern, forcing teams to apply greater scrutiny while still moving faster. This tension between speed and rigor now defines financial services hiring.

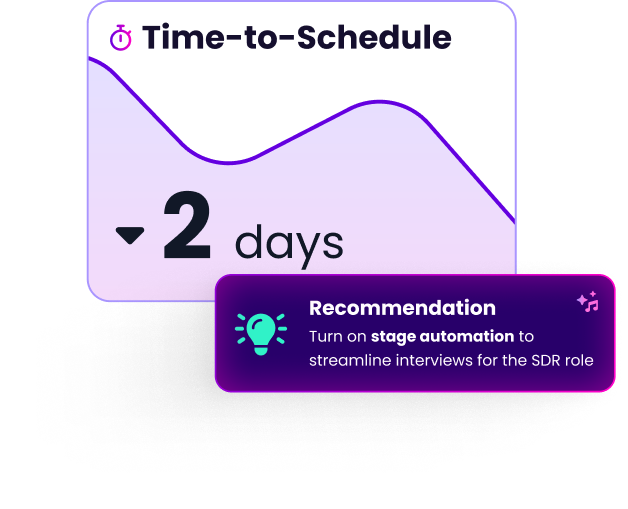

In response, leaders are prioritizing efficiency-first modernization. AI adoption is widespread, but impact depends on deployment. The most effective teams use AI as infrastructure—strengthening analytics, interview quality, and workflow reliability—rather than chasing speed through surface-level automation. Scheduling, despite being a primary source of delay, remains under-automated and represents one of the clearest opportunities for 2026.

The data points to a widening divide. Teams that modernize scheduling, standardize communication, and align AI with core workflow mechanics are better positioned to compete, regardless of market conditions. Those that rely on manual coordination and fragmented processes continue to absorb delay, risk, and candidate loss.

Financial Services snapshot

Hiring outcomes improved in 2025, but performance remains fragile

Time-to-hire continues to worsen for most financial services teams

Scheduling and interviewer readiness are the primary execution failure points

Fraudulent or AI-assisted candidate misrepresentation is a growing risk

AI adoption is high, but value depends on workflow integration

2026 priorities center on efficiency, tech modernization, and risk-aware speed

2025 performance review: Financial services hiring shows improvement, but remains fragile

Yet even with this improvement, performance remains structurally constrained. At 60% attainment, financial services organizations are still leaving a significant share of planned roles unfilled — a notable risk in a sector that depends on specialized skills, regulatory rigor, and consistent execution.

The volatility of recent years underscores the challenge. Hiring goal attainment rose in 2023, slipped in 2024, and then rebounded sharply in 2025, reflecting how sensitive outcomes are to execution quality. When scheduling breaks down, interviewer readiness falters, or decisions slow, performance regresses quickly.

The 2025 rebound appears driven less by easing market conditions and more by incremental operational gains. As this chapter will show, organizations that improved scheduling discipline, tightened communication, and invested in AI-supported workflows were better positioned to convert candidate interest into completed hires.

The implication for 2026 is clear: financial services hiring is improving, but not yet durable. Sustaining progress will require continued focus on execution systems (not just demand conditions) to prevent recent gains from proving temporary.

Time-to-hire continues to constrain financial services hiring

The data shows that hiring speed continues to move in the wrong direction for many organizations, with only a minority managing to meaningfully accelerate their processes. For most teams, hiring either slowed or failed to improve, reinforcing that execution challenges remain unresolved beneath the surface of better goal attainment.

This matters acutely in financial services, where hiring processes are often layered, risk-sensitive, and dependent on senior stakeholder availability. When interview coordination falters or feedback loops stall, delays compound quickly, increasing candidate drop-off and weakening competitive position.

The gap between improving outcomes and lagging execution speed suggests that recent gains are fragile. Some organizations are clearly finding ways to stabilize and accelerate hiring, but they remain the exception rather than the rule.

Where hiring execution breaks down

Candidate-side challenges remain present, including a lack of qualified applicants and rising withdrawals mid-process. But the data suggests these issues are often downstream effects of internal delays rather than primary causes. As timelines stretch, even strong candidates disengage.

Interviewer readiness is another critical fault line. Limited interviewer pools, untrained or underprepared interviewers, and delays in completing scorecards all contribute to uneven evaluation and slower movement. In a sector that values rigor and risk management, these inconsistencies create both speed and quality concerns.

GoodTime gives financial services leaders real-time visibility into hiring performance — paired with AI-powered recommendations that improve consistency, reduce delays, and support more confident hiring decisions.

Learn more

AI adoption emphasizes insight over speed in financial services

Adoption is strongest in interview intelligence, analytics, and interview preparation, areas where consistency, rigor, and defensibility matter most. This reflects the sector’s need to balance faster hiring with careful signal validation in a high-stakes environment.

More transactional use cases, such as sourcing, screening, and candidate-facing automation, are used more selectively. Notably, scheduling shows lower AI adoption than evaluative tasks, despite being a major source of delay elsewhere in the data.

The pattern points to a mature but incomplete AI strategy. Financial services teams are using AI to improve judgment, but many have yet to fully extend it to the workflow mechanics, especially scheduling, where it could deliver meaningful speed without sacrificing quality.

What financial services teams choose to measure

Quality of hire sits clearly at the center of measurement, reflecting the sector’s emphasis on long-term performance, risk mitigation, and defensible hiring decisions. This focus aligns with growing concern about candidate misrepresentation and reinforces why evaluation rigor remains non-negotiable.

Alongside quality, teams track a mix of efficiency and cost signals. Application completion and cost-per-hire point to awareness of funnel friction and budget pressure, while time-based metrics such as time-to-hire and time-to-fill indicate continued concern about execution speed, even if improvement has been uneven.

Operational stability also features prominently. Metrics tied to employee turnover and source of hire suggest that financial services leaders are watching not just how hires are made, but whether they stick and perform over time.

Overall, the data shows a sector that measures what it feels accountable for: quality, cost, and stability. The opportunity for 2026 is to more tightly connect these metrics to execution drivers, using funnel health and experience signals as earlier indicators, not just retrospective checks.

2026 outlook: Faster hiring, higher risk, and tighter margins for error

The dominant shift is the growing importance of connecting with candidates quickly. As competition for specialized talent remains intense, slow engagement is increasingly viewed as a direct cause of lost hires. Speed is no longer just an efficiency goal; it is a competitive requirement.

At the same time, leaders anticipate rising internal strain. Recruiter turnover, expanding candidate demands, and a growing number of required touchpoints are expected to make candidate flow harder to manage. These pressures compound existing execution challenges, particularly around scheduling, interviewer readiness, and decision follow-through.

Notably, the outlook reflects a fragmented market. Some leaders expect competition to intensify, while others anticipate easing conditions due to increased talent availability. The implication is clear: market conditions will vary, but execution quality will determine outcomes.

For financial services teams, 2026 will reward those that can move faster without sacrificing rigor: modernizing workflows, stabilizing coordination, and reinforcing trust at every stage of the hiring process.

Where financial services leaders are investing for 2026

Leaders are focused first on making hiring more efficient through AI and automation. Rather than experimenting at the margins, teams are looking to apply AI more deliberately to improve how work gets done, reducing manual coordination, stabilizing workflows, and enabling faster, more consistent decision-making. This emphasis reinforces a theme seen throughout the chapter: efficiency gains are no longer optional, but foundational.

Candidate experience remains a close second, with personalization, speed, and reliability at the center. Importantly, these goals are not positioned as soft initiatives. Improving experience is tightly linked to improving time-to-hire, offer acceptance, and candidate follow-through, especially in a market where top talent has leverage.

Standardization also rises as a priority. Financial services leaders are signaling the need to reduce variability across interviewers, processes, and timelines, particularly as concerns around candidate misrepresentation and interviewer readiness grow. Standardized processes are increasingly viewed as a safeguard for both speed and quality.

Taken together, the direction is clear. Financial services teams are moving away from fragmented, people-dependent execution toward system-led hiring operations. Those that successfully align AI, automation, and standardized workflows will be best positioned to hire faster, manage risk, and sustain the gains achieved in 2025.

Key takeaways for financial services leaders

Speed is the new baseline, not a differentiator.

Candidates expect rapid movement, clear timelines, and minimal friction. Teams that cannot coordinate interviews, feedback, and decisions quickly will continue to lose qualified talent, regardless of brand or compensation.

Efficiency must be designed into the system.

Manual scheduling, inconsistent interviewer readiness, and fragmented communication are structural liabilities. Leaders should prioritize workflow modernization that reduces coordination work and stabilizes execution across roles and regions.

AI delivers the most value when it strengthens judgment.

Financial services teams are right to focus AI on evaluation, analytics, and consistency. The next opportunity is extending those gains to operational mechanics where AI can accelerate hiring without compromising rigor.

Standardization protects both speed and quality.

As concerns about candidate misrepresentation grow, standardized interviews, clearer scorecards, and disciplined processes become essential. Consistency is no longer just an efficiency play. It’s a risk-management strategy.

Candidate experience follows execution health.

Personalization and relationship-building matter, but they cannot compensate for slow or unreliable processes. Improving experience in financial services starts with predictable timelines, transparent communication, and momentum.

2026 will reward disciplined operators.

Market conditions may fluctuate, but teams that invest in technology, reinforce execution discipline, and align speed with scrutiny will be best positioned to sustain hiring gains and build resilient talent pipelines.

The path forward

Copyright © 2026. Built with ❤️ all over the world.