2026

Hiring

Insights

Report

Healthcare

How 100+ healthcare talent leaders redefine hiring with AI and innovation

Executive summary

Hiring outcomes deteriorated year over year, with healthcare organizations achieving a smaller share of their hiring goals in 2025 than in 2024. This decline sits alongside rising time-to-hire and persistent candidate drop-off, indicating that healthcare teams are not simply dealing with demand shocks, but with systems that struggle to convert interest into hires.

Looking ahead, healthcare leaders are prioritizing efficiency, speed, and process reliability. Technology investment and selective use of AI are increasingly viewed as necessary infrastructure to stabilize hiring operations rather than optional enhancements.

Healthcare snapshot

Healthcare organizations achieved a smaller share of their hiring goals in 2025 than in 2024.

A lack of qualified candidates is the most significant hiring challenge healthcare teams experienced.

Time-to-hire increased for most healthcare organizations, reinforcing execution strain.

Candidate drop-off during the hiring process remains a leading source of friction.

Interviewer availability and delayed feedback are major contributors to hiring slowdowns.

Improving overall efficiency is the top priority for healthcare hiring leaders heading into 2026.

2025 performance review

This decline occurred alongside broader signs of strain. Time-to-hire increased for many healthcare teams, and competitive pressure remained high. Together, these signals suggest that hiring shortfalls were driven less by lack of effort and more by constraints in converting available candidates into completed hires.

Key challenges

Just below that top concern is a dense cluster of related problems: skills that do not align with resumes, too many applicants to effectively screen, and candidates dropping out during the process. This combination signals that healthcare hiring teams are dealing with both scarcity and noise at the same time.

Execution and workload pressures form the next layer. Unmanageable recruiter workload, candidates holding multiple offers, and rising compensation expectations all contribute to instability, but they do not rival talent availability in prominence.

Scheduling and communication bottlenecks

Closely following are delays in completing scorecards and the volume of applications requiring review. These responses point to pressure in the middle of the funnel, where decisions depend on busy clinicians and managers who are balancing hiring responsibilities with core operational work.

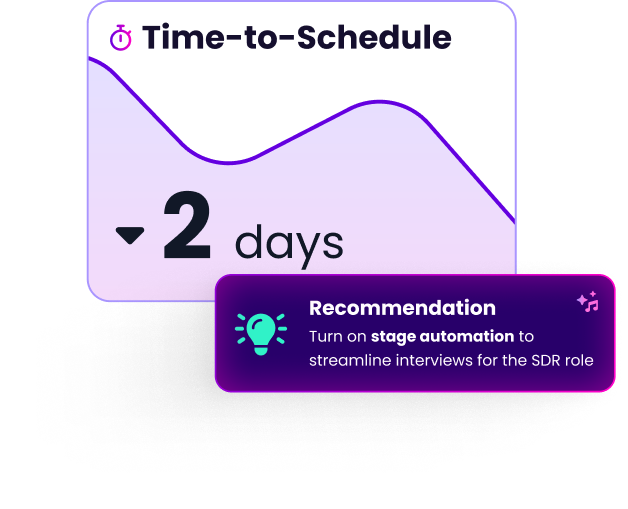

Scheduling delays and interview cancellations also feature prominently. However, the data suggests these are symptoms of a broader coordination problem rather than isolated failures. When interviewer availability is inconsistent and feedback cycles stall, scheduling becomes fragile and candidates wait longer than they are willing to tolerate.

GoodTime gives healthcare hiring leaders instant insight into critical hiring metrics — while AI-powered recommendations help reduce delays, improve coordination, and get qualified talent into care roles faster.

Learn more

Candidate engagement dynamics

This pattern aligns with the bottleneck data. Candidates are most likely to disengage when interviews are delayed, rescheduled, or followed by long periods of silence. Engagement, in this context, is not primarily about personalization or employer branding. It is about momentum and clarity.

Healthcare candidates appear willing to enter the process, but far less willing to remain in it when progress slows or expectations are unclear.

Technology adoption and the role of AI in healthcare hiring

A second tier of adoption supports interview execution, such as scheduling and interview analysis. These use cases reflect where healthcare teams feel the most operational pain: coordinating interviews, standardizing evaluation, and maintaining visibility into progress.

More candidate-facing automation, including chatbots and automated communications, appears lower in use. This suggests a cautious approach to automating interactions in a high-stakes hiring environment where trust and clarity matter.

Overall, AI is being positioned as supporting infrastructure, not as a substitute for clinical or managerial judgment.

Metrics healthcare teams prioritize

Quality of hire and time-based measures such as time-to-hire and time-to-fill also feature strongly. These metrics help teams assess whether hiring processes are producing durable results at a sustainable pace.

Candidate experience and conversion indicators are tracked, but they carry less weight than cost and retention-oriented measures. This suggests that healthcare organizations are primarily trying to control the operational and financial consequences of hiring instability.

2026 healthcare hiring outlook

Lack of qualified candidates and misalignment between skills and resumes remain close behind, indicating little expectation of relief on the supply side. Limitations of existing hiring technology also feature prominently, reinforcing concerns about whether current systems can support faster, more reliable execution.

The outlook reflects caution rather than optimism. Healthcare organizations are preparing for continued friction rather than a return to equilibrium.

2026 priorities

Cost control and process standardization form the next tier of priorities, reinforcing the focus on repeatability and predictability. Optimizing automation and using AI to improve efficiency appear as enabling strategies rather than headline goals.

Candidate experience and relationship-building are present but secondary. The data suggests that healthcare leaders view experience improvements as the result of faster, more reliable processes, not as standalone initiatives.

Broad intent to invest further in hiring technology underscores this approach. For healthcare teams, modernization is increasingly seen as a prerequisite for maintaining hiring capacity under sustained pressure.

Final thoughts and key takeaways for healthcare hiring leaders

Address talent scarcity and signal quality at the same time

A lack of qualified candidates is the defining challenge in healthcare hiring, but it is compounded by skills mismatch, high applicant volume, and mid-process dropout. Screening rigor and process speed must improve together. Solving only one side of the equation will not materially improve outcomes.

Protect interviewer capacity and decision follow-through.

Limited interviewer availability and delayed scorecard completion are the most consistent brakes on hiring speed. Healthcare teams gain more by clarifying interviewer expectations, standardizing feedback workflows, and reducing cognitive load than by adding more candidates to the funnel.

Treat scheduling and coordination as operational infrastructure.

Scheduling delays and reschedules are not isolated issues. They reflect fragile coordination across busy clinical stakeholders. Reliable, structured scheduling workflows reduce downstream delays and directly lower candidate dropout.

Use AI to stabilize interviewing and visibility, not to automate judgment.

Healthcare teams see the most value from AI when it supports analytics, interview preparation, and coordination. These uses improve consistency and transparency without undermining trust in high-stakes hiring decisions.

Measure outcomes that reflect durability, not just speed.

Cost-per-hire, turnover, quality of hire, and time-based metrics dominate healthcare measurement for a reason. They reveal whether hiring decisions hold up under operational pressure. Experience metrics matter, but they follow from reliable execution.

Efficiency is the strategy for 2026.

Healthcare leaders are prioritizing efficiency, time-to-hire, and offer acceptance because the system cannot absorb additional friction. Technology modernization and process standardization are increasingly prerequisites for maintaining hiring capacity.

The path forward

Copyright © 2026. Built with ❤️ all over the world.