2026

Hiring

Insights

Report

Manufacturing

How 100+ manufacturing TA leaders redefine hiring with AI and innovation

Executive summary

The most prominent pressure point is recruitment team turnover, which leads all reported changes affecting candidate flow. At the same time, manufacturing leaders describe a fragmented talent market, with some roles becoming more competitive while others see increased availability. This split environment makes consistency harder to maintain and places greater demand on hiring systems and recruiter capacity.

Across the process, leaders report higher candidate demands, more required touchpoints, and increased dropout, signaling that speed and coordination now play a larger role in conversion. In response, manufacturing organizations are prioritizing efficiency, personalization, and technology upgrades as foundational capabilities for 2026.

Manufacturing snapshot

Hiring goal achievement rose in 2025 to the highest point in four years

Recruitment team turnover is the most frequently cited change affecting candidate flow

Leaders report both increased competition and increased talent availability, depending on role

Candidate dropout and the need for more touchpoints increased

Efficiency, personalization, and hiring technology upgrades lead 2026 priorities

2025 performance review

This improvement is notable, but it does not signal reduced complexity. Instead, the performance gains appear to have been achieved under more demanding conditions, with teams absorbing higher workload, more variability in candidate quality, and greater internal disruption.

The takeaway is not that manufacturing hiring became easier, but that teams pushed harder and adapted, even as the operating environment grew more fragile.

Manufacturing hiring became harder to run, even as conditions diverged

At the same time, the talent market itself has fractured. Nearly as many leaders say hiring became more competitive due to increased demand as those who say it became less competitive because more talent is available. Rather than moving in one direction, manufacturing hiring conditions now vary by role, location, and skill set, forcing teams to operate in multiple modes at once.

Candidate-side expectations have risen in parallel. Building meaningful relationships and connecting with candidates quickly both increased in importance, alongside growing candidate demands and the need for more touchpoints throughout the process. These pressures point to higher engagement requirements rather than easier access to committed talent.

Together, these signals describe a hiring environment where process resilience matters more than market timing. Manufacturing hiring has not simply become more competitive or less competitive. It has become harder to execute consistently under mixed conditions, higher expectations, and ongoing internal disruption.

Coordination breakdowns, not sourcing alone, slow manufacturing hiring

Lack of qualified candidates remains a meaningful constraint, but it sits alongside conversion issues such as candidate withdrawals and delayed scorecard completion. This indicates that hiring slows not only at the top of the funnel, but as candidates move through the process.

Scheduling delays, high application volume, and poor communication with candidates further compound these issues, increasing the risk of disengagement. Taken together, the data shows a hiring system strained by multiple dependencies, where improving reliability and follow-through is as important as expanding access to talent.

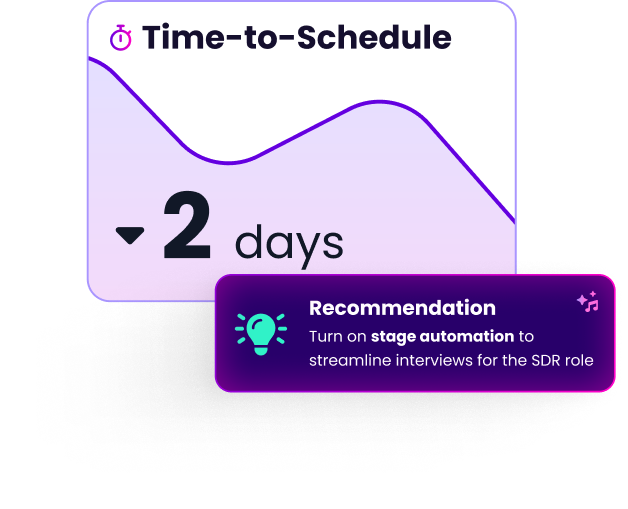

GoodTime gives manufacturing leaders clear visibility into hiring bottlenecks — with AI-powered recommendations that streamline scheduling, reduce downtime, and help teams secure skilled talent faster.

Learn more

Manufacturing teams apply AI where it reduces coordination and manual work

Interview scheduling sits near the top, reflecting the operational pressure to reduce back-and-forth coordination. Content-related tasks follow closely, including writing job descriptions and creating interview questions, suggesting teams are using automation to standardize inputs and reduce preparation time.

Screening and sourcing applications form a broad middle tier. These uses help manage volume, but they do not dominate adoption in the same way operational tasks do. Interview intelligence and analysis also appear at similar levels, indicating growing interest in extracting insight from interviews, even if adoption is still uneven.

Candidate-facing automation and drafting candidate communications trail the rest, while screener interviews appear lowest. Overall, the pattern shows manufacturing teams using AI as workflow infrastructure, prioritizing time savings and process stability over high-risk automation of candidate interactions.

Manufacturing teams measure outcomes that reflect durability and conversion

Diversity of candidates and employee turnover also appear prominently, signaling attention to workforce stability and composition beyond immediate hiring volume. Time-to-fill and application completion follow, suggesting growing but secondary interest in funnel mechanics.

Candidate interview experience and applicants per role trail the core outcome metrics, while source of hire appears lowest. Overall, the pattern shows manufacturing teams prioritizing results and sustainability over activity tracking, using metrics to evaluate whether hiring efforts produce durable outcomes rather than just throughput.

Manufacturing leaders expect volume, verification, and retention pressure in 2026

Just behind that top concern is a cluster of risk and retention issues. Retaining top talent and managing fake or fraudulent candidates rank at the same level, alongside skills that do not match resumes. Together, these responses point to growing concern about signal quality and trust in the hiring process.

Execution challenges remain prominent. New hires failing to show up, candidates dropping out mid-process, and limitations of current hiring technology all feature strongly, reinforcing that conversion and follow-through are expected to remain fragile.

A lack of qualified candidates appears, but it no longer stands alone as the dominant expected issue. Instead, it sits among a broader set of operational and verification challenges. Hybrid work complexity, recruiter workload, and internal policy changes round out the list, suggesting that 2026 risk is distributed across many points in the system, rather than concentrated in a single bottleneck.

Overall, manufacturing leaders appear to be preparing for a year where managing volume, validating candidates, and retaining talent will require as much attention as sourcing itself.

Priorities for 2026 center on conversion, automation, and technology investment

Automation and technology upgrades sit immediately behind that top priority. Optimizing automation, upgrading hiring technology, and using AI to improve efficiency all rank near the top, indicating that manufacturing teams view tooling as a necessary lever to handle volume, speed, and coordination challenges.

Candidate experience and time-to-hire also feature prominently, reinforcing that engagement and speed are tightly linked. Standardizing the hiring process and increasing personalization follow, suggesting a push toward consistency without fully sacrificing flexibility.

Cost reduction and scheduling-specific improvements appear lower, indicating that manufacturing teams are prioritizing effectiveness before efficiency gains at the margins.

Together, these signals point to a sector that is not experimenting cautiously, but actively preparing to modernize hiring operations to support higher expectations, heavier volume, and more complex decision-making.

Final thoughts and key takeaways for manufacturing hiring leaders

Stability matters as much as talent access.

Recruitment team turnover is the most disruptive force shaping manufacturing hiring today. Even as hiring outcomes improved in 2025, instability inside TA teams makes it harder to sustain progress. Process reliability and knowledge continuity are now strategic assets.

Fragmented markets demand flexible execution.

Manufacturing hiring is no longer uniformly competitive or relaxed. Leaders report both increased competition and increased talent availability, depending on role and location. Teams that rely on a single hiring motion struggle; those that can adapt speed, screening rigor, and engagement by role are better positioned to convert candidates.

Coordination failures are the biggest drag on speed.

Interview cancellations, limited interviewer availability, and delayed decisions outweigh sourcing alone as bottlenecks. Improving follow-through in the interview stage unlocks more value than expanding the top of the funnel.

Engagement is about momentum, not messaging.

Candidates require faster connection, more touchpoints, and clearer progress signals. Dropout rises when coordination falters. Manufacturing teams see better engagement when they remove delays rather than add personalization.

Use AI to harden workflows, not replace judgment.

Manufacturing teams are applying AI most effectively where it improves visibility, scheduling, preparation, and consistency. These uses reduce recruiter load and stabilize execution without introducing risk into candidate-facing decisions.

Measure what holds up over time.

Quality of hire, offer acceptance, time-to-hire, and turnover dominate manufacturing measurement for a reason. These metrics reveal whether hiring decisions convert and endure, not just whether activity occurred.

Modernization is no longer optional.

Manufacturing leaders are prioritizing automation, technology upgrades, and efficiency improvements because existing systems cannot absorb higher volume, verification risk, and execution complexity. Investment intent is strong because operational strain is real.

The path forward

Manufacturing hiring success in 2026 will depend less on market relief and more on system design. Teams that protect recruiter continuity, stabilize interview coordination, deploy AI as workflow infrastructure, and align metrics with durable outcomes will be best positioned to hire consistently in a fragmented, high-pressure environment.

Copyright © 2026. Built with ❤️ all over the world.