2026

Hiring

Insights

Report

Retail

How 100+ retail talent leaders redefine hiring with AI and innovation

Executive summary

Retail leaders are responding with a sharper focus on efficiency. Improving overall efficiency leads 2026 priorities, followed closely by upgrading hiring technology and optimizing automation. AI adoption is pragmatic and execution-driven, concentrated in analytics, reporting, scheduling, and screening—areas that improve visibility and speed without replacing human judgment.

How retail teams measure success reflects this mindset. Leaders prioritize metrics that reveal funnel friction and downstream outcomes, including application completion rate, quality of hire, offer acceptance, turnover, and time-to-hire. Looking ahead, continued capacity strain and rising complexity mean retail hiring success in 2026 will depend on strengthening workflow resilience rather than adding more volume.

Retail snapshot

Hiring goal attainment improves, but remains below expectations

Time-to-hire increased for most retail organizations

Signal quality and execution strain outweigh volume as core challenges

Interviewer availability and coordination drive delays

Efficiency, automation, and tech upgrades lead 2026 priorities

2025 performance review

Retail hiring performance continued to lag behind organizational needs. Despite incremental improvements in tooling and automation, most retail teams still missed hiring goals, reflecting how difficult it has become to sustain hiring velocity at scale.

Key challenges: Candidate scarcity, misrepresentation, and execution strain

The most common issue retail leaders report is skills misalignment (applicants whose capabilities don’t match their resumes) followed closely by a lack of qualified candidates. High application volume compounds the problem, forcing recruiters to filter more noise while still struggling to identify job-ready talent. Ongoing retention pressure keeps teams in near-constant backfill mode, limiting stability.

Execution strain adds another layer. Fake or misrepresented candidates, limitations in hiring technology, and policy changes slow decision-making and reduce predictability. Candidates juggling multiple offers, no-shows, and drop-off further increase friction when processes stall.

Overall, the chart shows that retail hiring is constrained less by sourcing reach and more by signal clarity, execution discipline, and system reliability.

Scheduling and communication bottlenecks

The top constraint retail leaders cite is a limited pool of available interviewers, which makes it difficult to move candidates through the funnel quickly, especially when store operations compete for the same time. Just behind that, retail teams are dealing with candidate-side and volume pressures: a lack of qualified candidates and too many applications to review. That combination forces recruiters to sift through more noise while still struggling to find true fit.

Communication and coordination issues still matter, but they show up as the next layer of friction. Poor communication with candidates ranks among the top bottlenecks, and downstream execution blockers, like delays in completing scorecards, interview cancellations or reschedules, and scheduling delays, compound the impact of limited interviewer capacity. Availability continues to be a theme: interviewer/hiring manager availability and delays from hiring managers in making decisions (26%) both reinforce how easily retail hiring stalls when the process depends on busy, distributed stakeholders.

The takeaway is clear: in retail, speed breaks down less because of a single scheduling tool gap, and more because interviewer capacity and decision follow-through can’t keep up with volume. The most effective fixes pair structured availability and scheduling workflows with clear accountability for feedback and decisions, so candidates aren’t left waiting long enough to withdraw.

GoodTime gives retail hiring leaders real-time visibility into high-volume hiring metrics — while AI-powered recommendations help reduce scheduling delays, improve speed, and keep frontline roles filled during peak demand.

Learn more

Technology adoption and the role of AI in retail hiring

The strongest adoption shows up in analytics and reporting, signaling that retail leaders are increasingly relying on AI to understand funnel health, spot slowdowns, and manage high-volume hiring more effectively. Close behind are interview-related use cases, including generating interview questions and coordinating interview scheduling, reflecting how much of retail hiring pressure sits in the middle of the funnel rather than at sourcing alone.

Retail teams are also applying AI to resume review, screening, and interview intelligence, indicating a growing focus on improving signal quality and consistency when volume is high. Candidate-facing automation, such as conversational AI and drafting communications, appears more selectively adopted, suggesting that many retail organizations are cautious about automating direct candidate interaction too aggressively.

Overall, the data reflects a pragmatic approach to AI in retail. Teams are using technology first as workflow infrastructure and decision support, not as a wholesale replacement for recruiters or hiring managers. The retail organizations seeing the most value are those aligning AI investment with their core realities like speed, volume, and limited recruiter bandwidth, while keeping human oversight where it matters most.

Metrics retail teams prioritize

The most commonly tracked metrics focus on early-funnel effectiveness and downstream outcomes. Application completion rate sits at the top, reflecting how critical it is for retail teams to understand where candidates drop out in a high-volume environment. Close behind is quality of hire, signaling that even in fast-paced retail hiring, teams are prioritizing long-term fit and performance rather than speed alone.

A second tier of metrics centers on conversion and stability. Offer acceptance rate, applicants per role, employee turnover, and time-to-hire are all widely measured, underscoring how retail leaders are trying to balance hiring velocity with retention and workforce continuity. These metrics help teams diagnose whether hiring slowdowns stem from candidate hesitation, role attractiveness, or internal execution issues.

Candidate experience metrics and cost-per-hire appear less dominant, suggesting that while experience and cost matter, they are often viewed as supporting indicators rather than primary decision drivers. Time-to-fill trails further behind, reinforcing that retail teams are more focused on keeping the funnel moving than on measuring the full end-to-end vacancy window.

Overall, the chart shows a pragmatic measurement strategy. Retail teams are tracking the metrics that reveal friction, drop-off, and hire quality across a large funnel, prioritizing operational visibility over purely financial optimization.

2026 outlook for retail hiring

The most frequently anticipated challenges cluster around how retail hiring is run day to day. Difficulty adapting hiring processes to remote or distributed environments and unmanageable recruiter workloads rise to the top, signaling continued pressure on team capacity and process design. These concerns sit alongside persistent signal-quality issues, including applicants whose skills do not match their resumes and an ongoing lack of qualified candidates.

Brand and infrastructure limitations also feature prominently. Many retail leaders anticipate challenges tied to employer branding and limitations in their current hiring technology, suggesting that existing systems may struggle to support hiring at the required speed and scale. At the same time, concern about fake or misrepresented candidates points to a growing need to verify authenticity without adding friction to already stretched processes.

Overall, the outlook reflects a retail hiring environment where success in 2026 will hinge on process resilience, recruiter capacity, and execution discipline across the funnel.

2026 priorities: technology upgrades remain the top focus

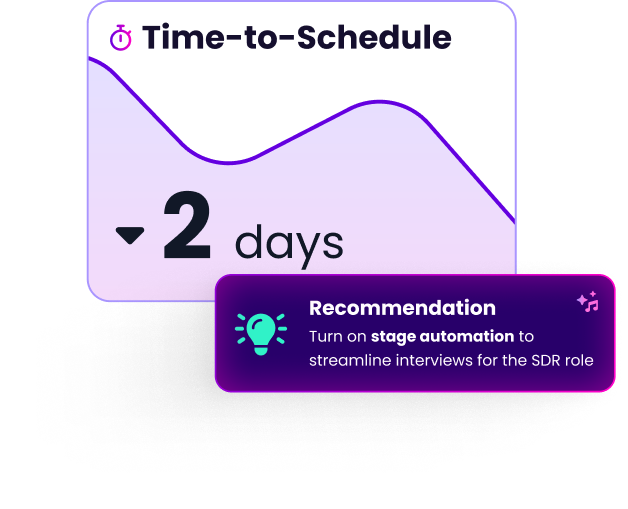

Improving overall efficiency clearly leads the agenda, reinforcing that retail teams see speed, throughput, and reduced friction as the most urgent needs. Upgrading hiring technology and optimizing automation follow closely, signaling that leaders view tech investment as a primary lever for achieving those efficiency gains,not as a secondary support.

Cost control and smarter use of AI also feature prominently, reflecting pressure to do more with constrained recruiter capacity while improving consistency across high-volume roles. At the same time, personalization, standardization, and incremental time-to-hire improvements appear as meaningful but secondary priorities, suggesting that retail teams are balancing flexibility with the need for repeatable, reliable processes.

Final thoughts and key takeaways for retail hiring leaders

Focus on capacity before volume

Limited interviewer availability and recruiter workload are the primary constraints in retail hiring. Protecting hiring time, clarifying interviewer accountability, and structuring availability unlock more value than adding applicants.

Treat scheduling as a system, not a task.

Interview coordination remains one of the biggest drivers of delay and candidate drop-off. Automated scheduling, self-service rescheduling, and standardized availability are now foundational capabilities for retail teams.

Use AI to improve visibility and speed—not to replace judgment.

Retail teams see the greatest gains when AI supports analytics, reporting, scheduling, and screening. These use cases strengthen decision-making and execution without eroding human oversight.

Measure funnel health and outcomes, not just activity.

Application completion, quality of hire, offer acceptance, turnover, and time-to-hire provide earlier and more actionable signals than cost or raw volume metrics.

Modernize communication to reduce drop-off and risk.

Centralized, consistent candidate communication improves response times, reduces confusion, and mitigates compliance risk in a mobile-first hiring environment.

Strengthen defenses against candidate misrepresentation.

As AI-assisted or misrepresented candidates become more common, retail teams must reinforce skill validation and structured evaluation without slowing the process.

The path forward

Copyright © 2026. Built with ❤️ all over the world.