2026

Hiring

Insights

Report

Technology

How 100+ tech TA leaders redefine hiring with AI and innovation

Executive summary

Despite deep familiarity with hiring technology, most tech organizations have not translated tooling into speed. Scheduling delays, interviewer availability, and inconsistent hiring manager readiness continue to slow progress, particularly in competitive roles where candidates often hold multiple offers. At the same time, skills misalignment and AI-assisted candidate misrepresentation have increased the cost of poor or rushed decisions.

The data shows that success in technology hiring now depends less on adding tools and more on operational discipline. AI delivers the greatest value when applied to analytics, reporting, and scheduling—areas that improve visibility, reduce coordination friction, and support faster decision-making. Teams that focus automation on workflow reliability outperform those that concentrate solely on top-of-funnel activity.

Candidate experience expectations in technology have also narrowed. Speed, transparency, and predictable momentum now matter more than additional touchpoints. Delays in scheduling, feedback, or decisions quickly erode trust and increase drop-off, regardless of employer brand strength.

Looking ahead, technology hiring performance in 2026 will be defined by execution quality. Teams that standardize workflows, strengthen interviewer readiness, modernize scheduling, and use AI as infrastructure, not experimentation, will be best positioned to compete for scarce technical talent.

Technology snapshot

Hiring goal attainment remains under pressure

Time-to-hire increased for most technology teams

Scheduling and coordination are the primary operational bottlenecks

Skills misalignment and AI-polished candidates complicate evaluation

AI is most effective when applied to analytics, scheduling, and workflow visibility

2025 performance review

The plateau highlights a persistent execution problem. Despite deep familiarity with hiring technology and widespread AI usage, many teams continue to struggle with extended time-to-hire, scheduling delays, and interviewer readiness. These factors compound in competitive technical roles, where candidates often move quickly and disengage when processes slow.

At the same time, skills misalignment and fraudulent candidate profiles have made evaluation more complex, increasing the risk of both false positives and prolonged decision-making. The result is a hiring system that is well tooled, but insufficiently coordinated to translate capability into consistent outcomes.

Core hiring challenges for technology teams

Close behind were candidates holding multiple offers and skills misalignment between resumes and actual capability, reinforcing a central tension for technology teams: candidates are moving faster, while signal is becoming harder to trust. Together, these dynamics force teams to slow evaluation and add steps at the very point where speed is most critical.

Brand and funnel quality issues continue to surface as secondary pressures. Suboptimal employer branding and difficulty attracting truly qualified candidates persist, while high applicant volume adds noise rather than relief. More candidates have not translated into better candidates, increasing screening effort and recruiter load.

Operational strain further compounds these challenges. Recruiter workload, interviewer readiness, and internal policy changes all contribute to delays across scheduling, feedback, and decision-making. The result is a hiring process that is well resourced on paper, but increasingly fragile in execution.

“The teams that are pulling ahead treat AI as both a tooling shift and a behavioral one. They set clear principles for how they’ll use AI, build tight operating norms around quality and consistency, and invest in upskilling so people feel confident adopting new workflows.”

Becky McCullough

VP, Talent Acquisition & Mobility, HubSpot

Time-to-hire pressures continue to intensify

In a sector where candidates often hold multiple offers, these delays are especially costly. Even minor friction in scheduling, feedback, or decision-making can derail otherwise strong candidates.

The takeaway is straightforward: technology teams are not losing talent because of low demand, but because processes are moving too slowly. Reducing time-to-hire will require eliminating coordination friction and improving scheduling and decision velocity across the hiring workflow.

Scheduling and coordination bottlenecks slow tech hiring

Volume adds friction rather than velocity. Many technology teams report reviewing too many applications, which increases screening time without improving candidate quality. This overload slows progress through the funnel and contributes to delayed feedback and decision-making.

Candidate-side fallout is a direct result. Withdrawals remain common as hiring timelines stretch, while limited interviewer capacity and underprepared interviewers further disrupt momentum. Even when qualified candidates are identified, delays in scorecard completion and hiring manager decisions extend cycles unnecessarily.

Taken together, the data shows that technology hiring is being slowed by workflow mechanics. Without more reliable scheduling, clearer ownership, and faster handoffs between recruiters and interviewers, improvements elsewhere in the process struggle to translate into faster or better outcomes.

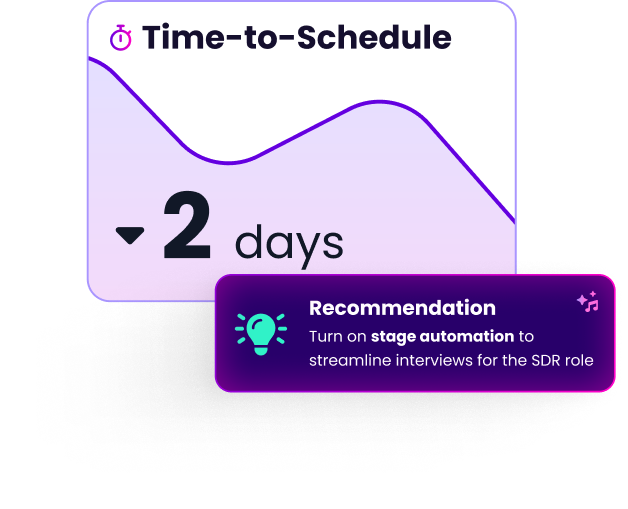

GoodTime gives tech hiring leaders instant visibility into hiring velocity and bottlenecks — with AI-powered recommendations that help teams move faster, scale efficiently, and win top technical talent.

Learn more

How technology teams are using AI and automation

Technology teams are applying AI across nearly every stage of the hiring lifecycle, from screening and interview preparation to communications and scheduling. Notably, analytics and reporting rank among the top use cases, signaling a growing emphasis on visibility and decision support rather than automation alone.

At the same time, adoption is not limited to back-office tasks. Candidate-facing tools, including conversational AI and automated communications, are widely used to maintain engagement as timelines stretch. Interview intelligence, question generation, and scheduling automation further support consistency in evaluation and reduce manual coordination.

What stands out is not how much AI technology teams are using, but where they are using it. The focus is shifting toward workflow reliability, signal clarity, and faster handoffs between stages. For technology leaders, the takeaway is clear: AI delivers the most value when it strengthens execution and insight, not when it simply adds more activity to the top of the funnel.

The hiring metrics technology teams prioritize

At the same time, quality and speed metrics are nearly as prevalent. Quality of hire and time-to-hire are both widely measured, reinforcing how closely technology teams link hiring success to both execution pace and downstream performance. In technical roles, where mis-hires are costly and skills are difficult to validate, these metrics serve as critical checks on decision-making.

Offer acceptance rate and employee turnover rate further reflect the sector’s focus on outcomes beyond the offer stage. Together, these measures help teams assess whether candidates are both choosing the organization and staying once hired, especially in a market where competing offers are common.

Candidate interview experience is tracked by a meaningful share of technology organizations, though it trails operational metrics. Rather than treating experience as a standalone goal, many teams appear to assess it indirectly through funnel conversion and completion rates, using those signals to diagnose friction in the process.

Overall, the metrics landscape in technology hiring suggests a shift toward system-level insight. The most effective teams are using metrics not just to report activity, but to understand where hiring slows, where signal breaks down, and where process improvements will have the greatest impact.

What technology hiring teams expect in 2026

Concerns around candidate signal and trust are rising. Fake or fraudulent candidates, including those using AI to misrepresent qualifications, are now a top expected challenge, adding pressure to evaluation processes that are already strained by speed requirements.

Work model friction remains unresolved. Candidate preference for fully remote work and ongoing difficulty adapting interviews to remote or hybrid environments continue to complicate coordination and expectation-setting in an increasingly office-first landscape.

Despite years of investment, many leaders still expect limitations in current hiring technology to persist, alongside recruiter workload strain and skills misalignment. Together, these pressures point to a 2026 hiring environment where success will depend less on new tools and more on improving execution, rigor, and workflow reliability.

Where technology teams are focusing in 2026

Speed remains a close second. Improving time-to-hire and optimizing automation rank near the top, reinforcing how deeply technology teams feel the cost of slow coordination and delayed decisions. Rather than chasing speed in isolation, leaders are prioritizing changes that reduce friction across the hiring workflow.

Candidate experience continues to matter, but it is increasingly defined by clarity, responsiveness, and momentum. Improving experience and increasing personalization remain important, though they trail efficiency-focused initiatives. This suggests that tech teams see experience as an outcome of better execution, not a standalone effort.

Technology modernization remains a meaningful, but not dominant, priority. Upgrading hiring technology and using AI to make hiring more efficient both rank mid-pack, reflecting a shift from acquiring tools to extracting more value from what teams already have. Standardization and time-to-schedule improvements appear lower on the list, but still reinforce the broader emphasis on workflow discipline.

Taken together, the priorities signal a pragmatic reset. Technology hiring teams are not chasing transformation for its own sake. In 2026, they are focused on tightening systems, moving faster with confidence, and making existing technology work harder to deliver consistent results.

Final thoughts and key takeaways for technology hiring leaders

Execution, not access to tools, is the defining challenge for technology hiring.

Despite widespread AI adoption and strong familiarity with hiring technology, most tech teams continue to struggle with speed, coordination, and decision confidence. The gap is no longer about capability; it is about how reliably hiring systems operate under pressure.

Treat scheduling as core infrastructure.

Scheduling delays, cancellations, and interviewer availability issues are the most consistent drivers of extended time-to-hire and candidate drop-off in tech. Automating coordination and reducing manual handoffs unlocks more speed than adding candidates or sourcing tools.

Strengthen signal validation without slowing the process.

Skills misalignment and AI-assisted candidate misrepresentation are now central risks. Technology teams must reinforce structured interviews, clearer scorecards, and consistent evaluation standards while maintaining momentum for candidates with multiple options.

Use AI where it improves visibility and workflow reliability.

The strongest impact comes from AI applied to analytics, reporting, and scheduling. These uses surface bottlenecks, improve decision-making, and reduce coordination load. Automation that only increases top-of-funnel activity does not address core constraints.

Redefine candidate experience around speed and clarity.

For tech candidates, experience is shaped less by personalization and more by responsiveness, transparency, and predictable movement through the process. Fast scheduling, timely communication, and clear next steps matter more than added touchpoints.

Measure the system, not just the activity.

Technology leaders are increasingly anchoring on quality of hire, time-to-hire, offer acceptance, and funnel health metrics. These measures reveal where execution breaks down and whether hiring outcomes hold up after the offer stage.

The path forward

Copyright © 2026. Built with ❤️ all over the world.