What top-performing TA teams do differently

20%

Top-performing TA teams are 20% more likely to use AI agents for interview scheduling

20%

Top-performing TA teams are 20% more likely to use AI agents for interview scheduling

Where many teams struggled with worsening time-to-hire, growing candidate demands, and rising workflow complexity, top performers built uncompromising systems around efficiency, automation, and quality. Their advantage was not incremental; it was structural.

"The best Talent teams aren't 'adding AI' — they're re-architecting how hiring works. Simply layering AI tools onto broken or inefficient processes won't drive impact. The real opportunity lies in auditing the end-to-end hiring journey, starting with the problem to solve, and intentionally redesigning it."

Manjuri Sinha

VP HR & Global Head of GTM Org Success & People Partners, Miro

The signature behaviors that set top performers apart

1.6x

more likely

Companies using automated or AI-driven scheduling were 1.6x more likely to achieve near-perfect hiring goal attainment.

They are 20% more likely to use AI agents for interview scheduling, and the payoff is measurable: teams that use automated scheduling are 1.6x more likely to achieve near-perfect hiring goal attainment (13% hitting 90–100%, compared with 8% of non-users).

On the surface, these choices can appear operational. In practice, they signal something far more consequential. While many organizations still rely on manual coordination to move candidates through the process, top performers have automated the most failure-prone part of hiring: scheduling.

By reducing back-and-forth, delays, and rescheduling cascades, these teams protect candidate momentum and recruiter bandwidth. The result isn’t just faster movement through the funnel, but a hiring process that is more predictable, more resilient, and easier to scale under pressure.

Their advantage isn’t simply tool adoption; it’s that they invest in automation where it directly improves outcomes.

Who top performers are, and the conditions that enable them

Top-performing teams are more likely to work within stable organizational structures. They were almost twice as likely to report no layoffs in the past year and 74% more likely to have reorganized roles without reducing headcount, a sign that their organizations protected continuity rather than resetting workflows amid turbulence. Stability doesn’t guarantee performance, but it creates the conditions for it: clearer ownership, less churn, and systems that don’t need to be rebuilt every quarter.

Together, these conditions allow top performers to focus less on firefighting and more on system design.

How top performers operate differently than everyone else

Automation is replacing headcount growth as the path to hiring success

Despite operating in the same market conditions as everyone else, top-performing TA teams are less likely to grow headcount, even as they achieve significantly higher hiring goal attainment. Instead of expanding teams to absorb rising complexity, they modernize their infrastructure to remove it. While 60% of underperforming teams grew headcount over the past year, fewer than half of top performers did the same. Instead, top performers were far more likely to keep headcount stable while reorganizing roles, signaling a deliberate shift away from logistics-heavy work and toward higher-leverage responsibilities.

This pattern reflects a fundamentally different operating model. Top-performing teams lean into automation, AI-powered scheduling, and workflow orchestration to eliminate the manual coordination that slows hiring down. By reducing scheduling drag, communication friction, and process noise, they increase throughput without increasing staffing.

The result is not just efficiency—it’s resilience. These teams hit hiring goals at a higher rate and avoid the cycle of constant headcount expansion that many organizations rely on to keep pace.

In 2026, the strongest TA organizations aren’t scaling by hiring more recruiters. They’re scaling by building systems that make recruiters more effective.

Top performers thoughtfully embrace AI agents

Top-performing TA teams are significantly more likely to use AI agents for core workflow mechanics and decision support, not just surface-level automation. Their highest adoption areas, analytics and reporting (43%) and interview scheduling (42%), map directly to the two biggest operational levers in hiring: visibility and speed. By contrast, teams that underperform are less likely to apply AI in these system-level functions, limiting its impact on overall hiring outcomes.

Notably, top performers also lean more heavily into structured evaluation tools, including scorecard analysis and interview intelligence. This suggests a more mature use of AI, one focused on improving signal quality and consistency, not just reducing manual work.

Where top-performing teams don’t over-invest is equally telling. They are less differentiated in areas like candidate sourcing and conversational AI, reinforcing a broader theme from this year’s data: automation at the top of the funnel is not what drives results. Instead, gains come from tightening execution in the middle of the hiring process, where delays, cancellations, and poor coordination most often derail outcomes.

In short, top-performing teams treat AI as infrastructure, not experimentation. They deploy it where it compounds—speeding scheduling, improving insight, and reinforcing hiring discipline—while others remain stuck using AI tactically rather than transformationally.

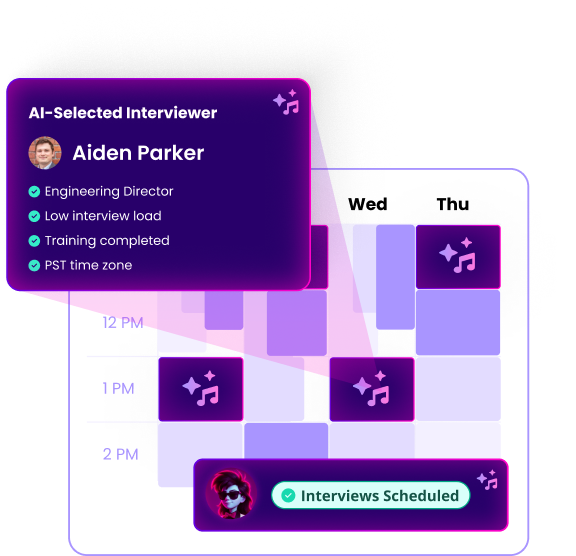

Fully automate scheduling for any interview loop — from multi-day panels to global coordination.

GoodTime's AI selects the right interviewers, resolves conflicts automatically, and adapts instantly when plans change — keeping schedules tight and hiring on track.

Learn more

AI-powered scheduling as a core operating mechanism

For top performers, AI scheduling isn’t a convenience feature — it’s foundational.

Top-performing teams were:

20%

more likely to use AI agents for interview scheduling

16%

more likely to run a fast, streamlined interview process

18%

more likely to offer automated scheduling options directly to candidates

Where others still rely on people to move calendars, top performers use systems.

“The fastest teams don’t work ‘harder’; they design hiring like a product and think with the candidate in mind. They front load clarity: tight intake meetings, clear success profiles, scorecards, and aligned decision makers before the role goes live. They treat time-to-hire as a system metric, not a TA-only KPI.”

Kobi Ampoma

Head of Talent Acquisition (NL), The HEINEKEN Company

Centralized, structured communication, not ad hoc messaging

Top performers were 58% more likely to use a centralized texting platform This shift away from personal phones and fragmented messaging channels does more than tidy up communications. It fundamentally reshapes hiring operations by enabling:

- Faster response times

- Consistent candidate messaging

- Better compliance and documentation

- Reduced candidate drop-off

- Clearer accountability across the team

Top performers treated communication not as a task, but as a system that needed governance.

How top performers measure success

Their measurement philosophy is sharper, more sophisticated, and far more focused on downstream impact than their peers.

Quality of hire is the anchor metric

Top performers were:

22%

more likely to track quality of hire

42%

more likely to select it as their top hiring metric

Where many teams still lean on volume-based or speed-based measures, top performers look at what happens after the hire.

“AI has raised the bar on what ‘verification’ actually means. A single background check at the end of the process isn’t enough anymore. TA teams now have to confirm identity and authenticity at multiple points - starting at application, continuing through assessments and interviews, and carrying all the way through onboarding.”

Becky McCullough

VP, Talent Acquisition & Mobility, HubSpot

Funnel health takes priority over funnel volume

- Where friction exists in the early funnel

- Whether job postings and processes are aligned with candidate expectations

- How effectively the system converts interest into engagement

It’s a more mature, more diagnostic approach, one that strengthens every downstream stage of hiring.

Less emphasis on cost-per-hire

The reason is simple: Cost metrics don’t predict hiring outcomes. Quality, velocity, and funnel integrity do.

This doesn’t mean cost doesn’t matter. It means top performers refuse to optimize for short-term savings at the expense of long-term hiring effectiveness.

A measurement system designed for clarity, not complexity

- Measure performance, not activity

- Track what influences outcomes, not what’s easiest to quantify

- Use data to surface friction, not justify the status quo

- Prioritize metrics that support speed and quality in an environment of rising candidate misrepresentation

“We’re not just looking at metrics like quality of hire now. We’re also reassessing where our bar is for things like time-to-fill and time-to-hire. What GoodTime is really good at is enabling us to quantify how much we can improve metrics and whether those improvements are within our control.”

Robbie Simpson

Head of Talent Acquisition, Glovo

In short, top performers don’t just use better tools—they use better metrics. And those metrics allow them to see the hiring system clearly enough to fix what others can’t.

Top performers' priorities for 2026

In contrast to organizations that are still reacting to rising fraud, worsening time-to-hire, and increased operational strain, top performers are proactively strengthening the systems that drove their gains. Their 2026 priorities read less like a wishlist and more like a continuation of a proven strategy.

Improving overall efficiency

- Removing friction from every stage of the funnel

- Reducing coordination load

- Increasing workflow reliability

- Streamlining decision paths

Improving time-to-hire

Their focus reflects an understanding that speed is no longer a nice-to-have, it is:

- A defense against candidate dropout

- A competitive differentiator in a market with heightened candidate expectations

- A requirement for maintaining internal trust in TA

Top performers treat time-to-hire as a system-level output, not an isolated metric.

Upgrading hiring technology

In 2026, they are more likely to invest in:

- AI-driven scheduling

- Automated communication workflows

- Centralized texting platforms

- Analytics and bottleneck diagnostics

Enhancing the candidate experience through speed, clarity, and flexibility

- Fast interview-to-offer timelines

- Clear, automated communication

- Self-scheduling and self-rescheduling

- Reduced ambiguity and fewer touchpoints

The blueprint: what others can learn from top performers

The blueprint they offer is not abstract. It’s practical and immediately actionable:

Treat scheduling as a strategic system, not an administrative task.

Top performers automate coordination end-to-end, enabling faster movement and freeing teams from the single largest operational burden.

Centralize communication to eliminate inconsistency and reduce dropout.

By consolidating texting and candidate outreach, they create a predictable, timely communication rhythm that keeps candidates engaged and reduces risk.

Deploy AI where it improves judgment and workflow reliability.

Instead of concentrating automation at the top of the funnel, they weave AI into screening, question generation, analytics, and reporting, the areas that shape quality, velocity, and decision-making.

Anchor measurement in quality and funnel health.

Top performers track the metrics that actually forecast hiring success: quality of hire, completion rates, conversion patterns, and downstream outcomes. And they deprioritize metrics, like cost-per-hire, that create false efficiency.

Cultivate organizational stability and role clarity.

Reorganizations, not reductions, give teams the stability to adopt new tools and refine workflows. Flexibility in work models enables faster coordination and stronger adoption of modern technology.

Build candidate experiences around speed, clarity, and flexibility.

Top performers understand that today’s candidates value momentum more than polish. Self-service, automation, and transparent updates create the experience candidates now expect and competitors struggle to match.

Copyright © 2026. Built with ❤️ all over the world.