Editor’s note: The article below is an excerpt from GoodTime’s 2025 Hiring Insights Report. The entire report is available to view online for free here.

In the last year, financial services hiring leaders faced an unforgiving talent landscape shaped by fierce competition, rapid technological advances, and evolving workforce demands. Top-tier candidates with specialized skills were in high demand but in short supply, forcing organizations to rethink their hiring strategies to stay ahead. Recruitment team burnout, inefficiencies in hiring workflows, and the rise of AI—both as a solution and a challenge—added further complexity. From candidates misrepresenting qualifications with AI tools to ongoing pressure to reduce time-to-hire, teams grappled with balancing speed, accuracy, and candidate experience.

This chapter uncovers how financial services leaders are responding to these challenges and charting a path forward. Key trends include a heightened reliance on technology and automation to streamline processes, the prioritization of candidate experience to win over top talent, and a renewed focus on operational efficiency to overcome hiring bottlenecks. Looking to 2025, financial services hiring teams are doubling down on refining processes, embracing AI to drive smarter decision-making, and building resilient recruiting systems to thrive in a competitive, rapidly evolving labor market.

Unlock finance’s top hiring strategies in 2025

Our study of 105 financial services TA leaders reveals how to hit your hiring goals in a challenging market.

Executive summary: Key financial services hiring trends for 2025

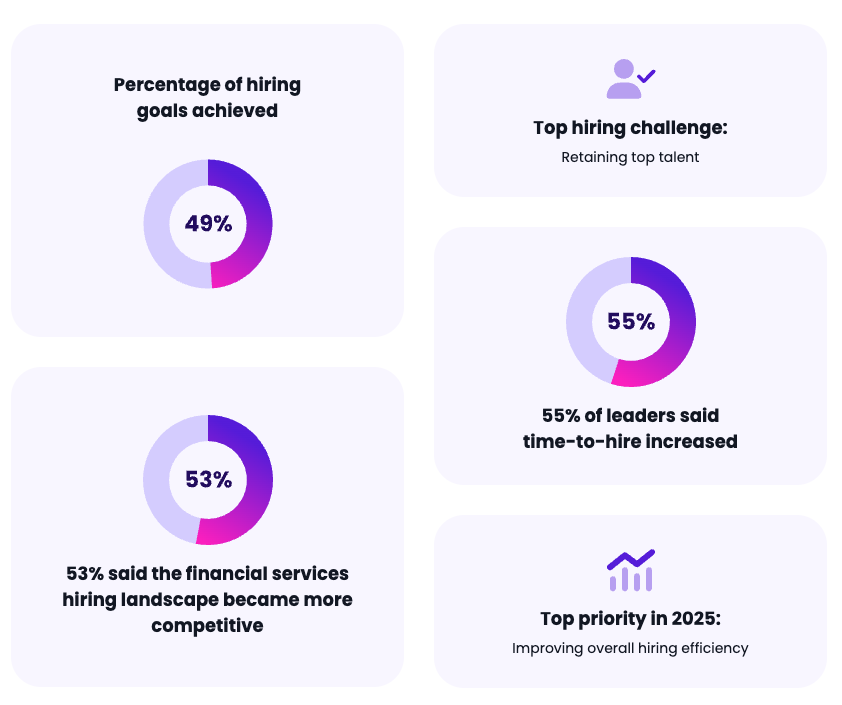

- 49% of hiring goals were achieved.

- 53% of respondents said the financial services hiring landscape became more competitive.

- 55% of leaders reported an increase in time-to-hire.

- Top hiring challenge: Retaining top talent.

- Top priority for 2025: Improving overall hiring efficiency.

Looking back at 2024: Financial services hiring stagnates

In 2024, financial services hiring teams faced a turbulent year, with only 49% achieving their hiring goals—a slight decline from 52% in 2023. This stagnation reflects the challenges of navigating a competitive talent market while balancing sector-specific demands, such as the need for specialized skills and compliance-focused hiring. Retaining top talent (36%) emerged as the most significant challenge, as competitive compensation and evolving candidate expectations pushed financial services organizations to rethink their retention strategies.

Adapting to hybrid interview processes and addressing unmanageable recruiter workloads further complicated efforts to attract and retain qualified candidates.

The sector also grappled with emerging challenges, including candidates misrepresenting their qualifications using AI and outdated hiring technologies slowing recruitment cycles. These issues highlight the growing need for financial services organizations to modernize their processes and refine strategies to compete for skilled talent while addressing operational inefficiencies.

Bottlenecks drive increased time-to-hire

in financial services

In 2024, 65% of financial services organizations reported an increase in time-to-hire, reflecting persistent inefficiencies and challenges in the hiring process.

Key bottlenecks, such as interview cancellations or reschedules (61%) and untrained or underprepared interviewers (41%), slowed hiring timelines and disrupted candidate engagement. Poor communication with candidates and a lack of qualified applicants (both at 41% and 40%, respectively) further compounded these delays.

These bottlenecks highlight the critical need for financial services organizations to improve internal coordination and enhance candidate communication. Addressing these gaps with better interviewer training, streamlined scheduling, and technology-driven solutions will be essential for reducing time-to-hire and maintaining competitiveness in the current market.

The financial services hiring landscape became more complex in 2024 as rising candidate expectations and increasing recruiter turnover strained hiring operations. With candidates demanding more personalized experiences, recruiting teams faced greater workloads while also navigating intensified competition for top talent.

To stay competitive, many organizations have focused on improving candidate engagement and better supporting their recruitment teams. However, ongoing challenges like candidate drop-off and expanded hiring funnels suggest a need for more streamlined processes that balance speed with quality.

How financial services addressed hiring challenges in 2024

In 2024, financial services organizations prioritized operational improvements, with a strong focus on process efficiency and automation to address hiring challenges.

The top initiatives—improving overall efficiency, leveraging AI, upgrading hiring technology, and automating workflows—clearly reflect a sector-wide shift toward reducing manual workloads and optimizing hiring speed.

This emphasis on streamlining operations suggests a response to growing pressure to meet hiring goals more effectively. While efficiency remains the focus, balancing it with personalization and candidate experience improvements further down the list indicates the industry is still working to find the right balance between speed and quality in talent acquisition.

Automation and AI adoption were particularly impactful, with application and resume review (55%) and analytics and reporting (51%) being the most common use cases. Tools such as AI recruiters and chatbots (47%) and automated interview scheduling solutions (43%) further reduced manual workloads and improved process efficiency. Despite these advancements, areas like candidate sourcing (38%) and interview analysis (41%) highlight opportunities for further innovation to enhance decision-making and engagement in 2025.

Building a fast and simple recruiting process for candidates

Financial services organizations prioritized speed and transparency to streamline the candidate experience. Improved scheduling efficiency for both candidates and interviewers (58%) and transparency in the interview process (57%) were top initiatives, reflecting the sector’s focus on reducing friction and enhancing engagement. A fast interview-to-offer process (52%) further underscored the need to move quickly in a highly competitive market.

Candidate experience tools, automated scheduling, and options for rescheduling through platforms showcased the sector’s increasing reliance on technology to simplify hiring workflows. These measures helped financial services organizations provide a more seamless and flexible process for candidates while positioning themselves as efficient and attractive employers.

How financial services hiring teams measure success

In 2024, financial services hiring teams focused on recruiting metrics that emphasize efficiency and long-term outcomes. Quality of hire (51%) emerged as the most commonly tracked measure, showing the sector’s emphasis on securing high-performing talent. Cost-per-hire (44%) and time-to-hire (43%) were also key metrics, highlighting the need to balance hiring speed with budgetary constraints.

Candidate experience metrics, such as interview feedback (43%), are gaining traction, indicating a shift toward more candidate-centric evaluations. Metrics like diversity of candidates (39%) and application completion rate (38%) signal efforts to improve inclusivity and process effectiveness.

How financial services talent leaders are evolving in 2025

As financial services organizations look ahead to 2025, leaders anticipate a challenging hiring environment marked by rising recruiter turnover, increased competition for talent, and mounting pressure to engage candidates faster. With 59% citing recruitment team turnover as a key disruptor, hiring teams already facing capacity issues may struggle to keep pace with the demands of a competitive labor market.

The need to connect with candidates quickly and build stronger relationships continues to grow in importance as firms try to balance speed with quality hires. At the same time, expanded hiring funnels and increased touchpoints are adding complexity to already stretched recruitment teams. These trends point to a critical need for strategies that ease recruiter workload, such as recruiting automation and process standardization, while keeping the focus on meaningful candidate engagement.

Key challenges predicted for 2025 include retaining top talent (39%) and addressing skill mismatches among applicants (35%). Changes in hiring policies, difficulty adapting interview processes to remote or hybrid models, and an overwhelming number of applicants are also expected to persist, creating further complexity for hiring teams. These trends underscore the need for financial services leaders to adopt targeted strategies to manage growing demands while maintaining process efficiency.

By proactively addressing these anticipated changes and challenges, financial services organizations can better position themselves to attract and retain top talent in a labor market that continues to evolve rapidly. Investing in technology, streamlining processes, and enhancing candidate engagement will be essential for navigating the year ahead.

Financial services leaders are

going all in on AI

In 2025, financial services organizations remain focused on the same core hiring priorities as the previous year: leveraging AI for hiring efficiency (47%), improving overall efficiency (45%), and upgrading hiring technology (43%). The fact that these areas continue to top the list underscores that while progress has been made, critical inefficiencies persist across the hiring process. Leaders are still working to strike the right balance between operational speed and long-term workforce sustainability.

Technology investments are expected to play a central role in tackling these challenges, with 90% of organizations planning to invest further in automation and tools to streamline workflows. Standardizing processes, enhancing personalization, and improving offer acceptance rates also remain critical focus areas as teams aim to stay competitive in a demanding labor market.

By staying committed to efficiency, modernization, and candidate engagement, financial services teams are positioning themselves to reduce hiring bottlenecks and better manage ongoing workforce demands in the year ahead.

Final thoughts and key takeaways

This year, financial services hiring teams faced a challenging environment marked by increased competition for talent, retention struggles, and inefficiencies in hiring processes. As demands for skilled professionals intensified, organizations leaned on technology and automation to address bottlenecks and improve candidate engagement. However, persistent issues like recruitment team turnover, mismatched skills, and poor communication highlighted the ongoing need for innovation and adaptability.

Looking ahead to 2025, financial services leaders should prioritize:

- Investing in hiring technology: Upgrading tools to automate workflows, streamline scheduling, and enhance decision-making will be critical for reducing time-to-hire and improving efficiency in a fast-paced sector.

- Enhancing candidate engagement: Transparency, personalization, and faster hiring timelines will help attract top talent and foster stronger relationships with candidates in an increasingly competitive labor market.

- Building recruiter and hiring team capacity: Providing comprehensive training and leveraging automation can alleviate the burden on overextended hiring teams, enabling them to maintain high performance while navigating complex demands.

- Focusing on actionable metrics: Tracking candidate experience alongside metrics like time-to-hire and cost-per-hire will provide valuable insights to refine processes and strengthen competitive positioning.

Upgrade your hiring journey with AI

GoodTime’s AI agents orchestrate the entire hiring journey — screening, scheduling, messaging, and more — so talent teams hire faster with a better candidate experience.