Editor’s note: The article below is an excerpt from GoodTime’s 2026 Hiring Insights Report. The entire report is available to view online for free here.

Introduction from Ahryun Moon

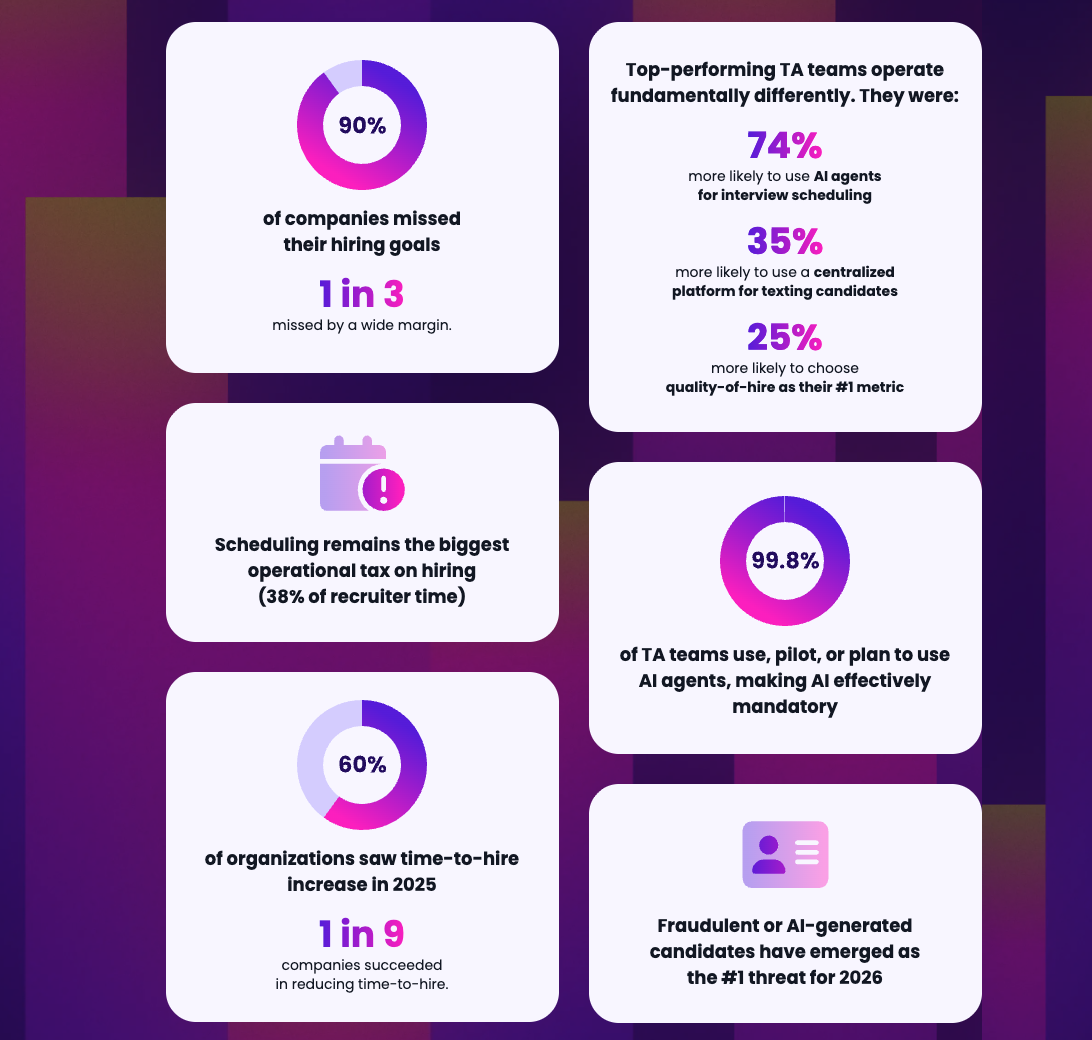

Hiring in 2026 is defined by both progress and pressure. While some teams are improving, the broader picture remains sobering: 90% of companies missed their hiring goals, and talent acquisition continues to operate under sustained structural strain. Nearly every organization now relies on AI, but this shift has introduced a new reality—fake or AI-generated candidates have emerged as the number one anticipated hiring threat for the year ahead.

At the same time, long-standing operational bottlenecks, especially scheduling, continue to slow hiring when speed matters most. The result is a market where authenticity, efficiency, and execution discipline are no longer differentiators; they are prerequisites.

Yet the teams that are outperforming the market tell a different story. They didn’t respond to pressure by simply adding headcount, or even by cutting it. Instead, they reorganized. Top-performing teams redesigned roles, workflows, and responsibilities around an AI-enabled reality, using automation to absorb operational load while elevating human judgment, coordination, and candidate connection.

These teams automate intentionally, standardize what should be repeatable, and leverage AI for insight—not just efficiency. In doing so, they protect the human touchpoints that define great hiring experiences, even as their processes become faster and more resilient.

I hope this year’s report inspires you to build toward that future—one where technology amplifies human connection rather than replaces it, and where hiring teams are structured to operate with confidence in an increasingly complex market.

Warm regards,

Ahryun Moon, CEO and Co-Founder, GoodTime

Unlock 2026’s top hiring strategies: Insights from 500+ TA leaders

Be the first to uncover deep hiring insights specific to your sector — straight from the highest-performing TA teams.

Key findings at a glance

- Fraudulent or AI-generated candidates have emerged as the #1 threat for 2026.

- 90% of companies missed their hiring goals, and 1 in 3 missed by a wide margin.

- 99.8% of TA teams use, pilot, or plan to use AI agents, making AI effectively mandatory.

- Scheduling remains the biggest operational tax on hiring (38% of recruiter time).

- 60% of organizations saw time-to-hire increase in 2025.

- Only 1 in 9 companies succeeded in reducing time-to-hire.

- Top-performing TA teams operate fundamentally differently. They were:

- 74% more likely to keep headcount flat while reorganizing roles

- 58% more likely to use a centralized platform for texting candidates

- 20% more likely to use AI agents for interview scheduling

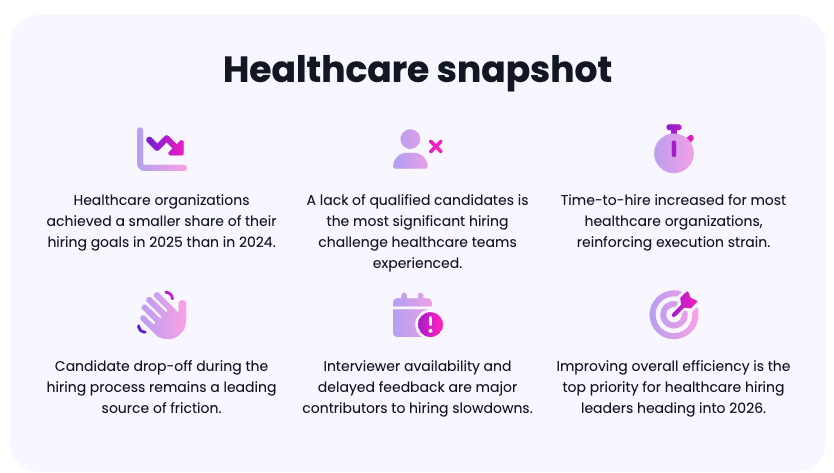

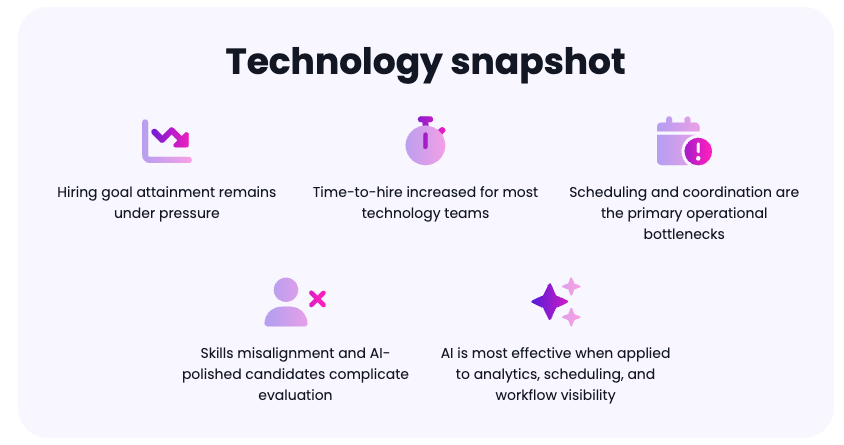

Hiring goal attainment hits a five-year high but still signals a systemic struggle

At first glance, 2025 delivered a surprising headline: hiring goal attainment reached its highest point in five years. But a closer look reveals a more sobering truth. Performance remains dramatically below expectations, with most organizations continuing to fall short of their hiring targets.

More than a third of companies (34%) hit less than half of their hiring goals, and only a small fraction (10%) came close to achieving 90–100% of their targets. Most landed somewhere in the middle, filling between 50–74% of roles but still failing to meet organizational needs.

This paradox—the best year in five years, yet still deeply underperforming—reflects mounting competitive pressures, rising process complexity, and an increasing mismatch between talent acquisition teams’ capacity and the demands placed on them. For many organizations, hitting goals is no longer a matter of marginal improvement; it requires a structural transformation of how hiring operates.

“The headcount plan can often be a moving target. Criteria shift mid-search and teams are adjusting hiring priorities in response to changing business needs. When targets move often, it becomes almost impossible for TA teams to hit their goals. The quickest way to improve is early alignment between Executives, Finance, TA, and Hiring Managers, with clear priorities and expectations.”

-Shelby Wolpa, Founder, Shelby Wolpa Consulting

Top overall hiring challenges

This year’s data reveals a hiring environment defined not by a single dominant barrier, but by overlapping obstacles across skills, volume, technology, and candidate behavior.

The most widespread challenge was skills misalignment, cited by 28% of TA leaders. Even when candidate pipelines were strong, recruiters struggled to find applicants whose capabilities matched the expectations set on their résumés. This reflects a growing disconnect between what candidates present and what organizations need, a theme that resurfaces repeatedly throughout this year’s findings.

28% of organizations also reported a lack of qualified candidates, continuing a long-standing pain point for TA teams. Yet the data suggests this shortage is now being compounded by other dynamics, including shifting work models and compensation expectations.

Retention pressures persisted as well, with 27% of TA leaders citing retaining top talent as a major challenge. As skilled workers continue to command multiple offers and leverage competitive markets, companies face mounting pressure to deliver compelling experiences both before and after hire.

The emergence of fake or AI-assisted candidates, cited by 23% of leaders, marks one of the most notable new pressures. Although not the most common challenge this year, their rising prevalence signals an accelerating shift in candidate behavior and sets the stage for why fraudulent candidates become the top anticipated threat for the coming year.

“AI and generalized economic precarity across the globe has created the perfect storm which has deluged traditional hiring funnels with job applications. Recruiters and hiring managers alike are both now aware of the challenge of separating signal from noise. ID verification, background checks, fraud detection and cybersecurity are now becoming much more important elements of a recruiter’s job.”

-Hung Lee, Founder, Recruiting Brainfood

How the hiring landscape changed this year

The most widely felt change in the hiring landscape this year was the surge in candidate demands, with 45% of TA leaders reporting an increase in required touchpoints. An equal share said recruitment team turnover disrupted their ability to maintain steady candidate flow, adding operational strain at a time when processes were already stretched.

Competition for talent also intensified: 44% said the landscape has become more competitive due to increased demand, while 39% reported that building meaningful relationships with candidates has become more important. Speed of engagement rose in priority as well, with 38% noting the growing importance of connecting with candidates quickly.

At the same time, shifts in available talent created mixed conditions across industries. 38% said the landscape feels less competitive due to greater talent availability, while 34% now need more candidates in the funnel to meet hiring goals.

Overall, hiring in the past year became higher touch, higher urgency, and more operationally demanding—challenging TA teams to do more with less in an increasingly dynamic talent market.

Time-to-hire continues to worsen for most teams

The time-to-hire crisis shows no signs of easing.

- 60% of companies reported that time-to-hire increased in 2025.

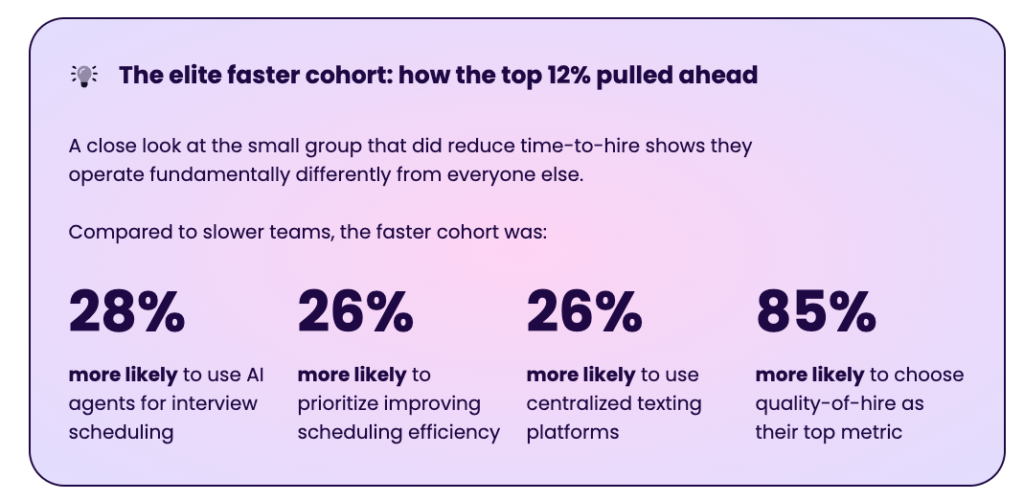

- Only 12% managed to reduce it, an elite minority.

This means nearly nine out of ten organizations are either slowing down or treading water.

The year-over-year persistence of this trend reveals a deeper issue: technology adoption alone is not enough to create speed. Without disciplined workflows, streamlined communications, and clearer ownership across the hiring process, new tools often reinforce existing complexity instead of reducing it.

Just as important is what they didn’t do. Faster teams were:

- 40% less likely to rely on sourcing bots

- 56% less likely to use chatbots for early candidate engagement

These leaders focused on structural process improvement rather than volume-driven shortcuts. They modernized the internal mechanics of hiring instead of adding more candidates to an already strained system.

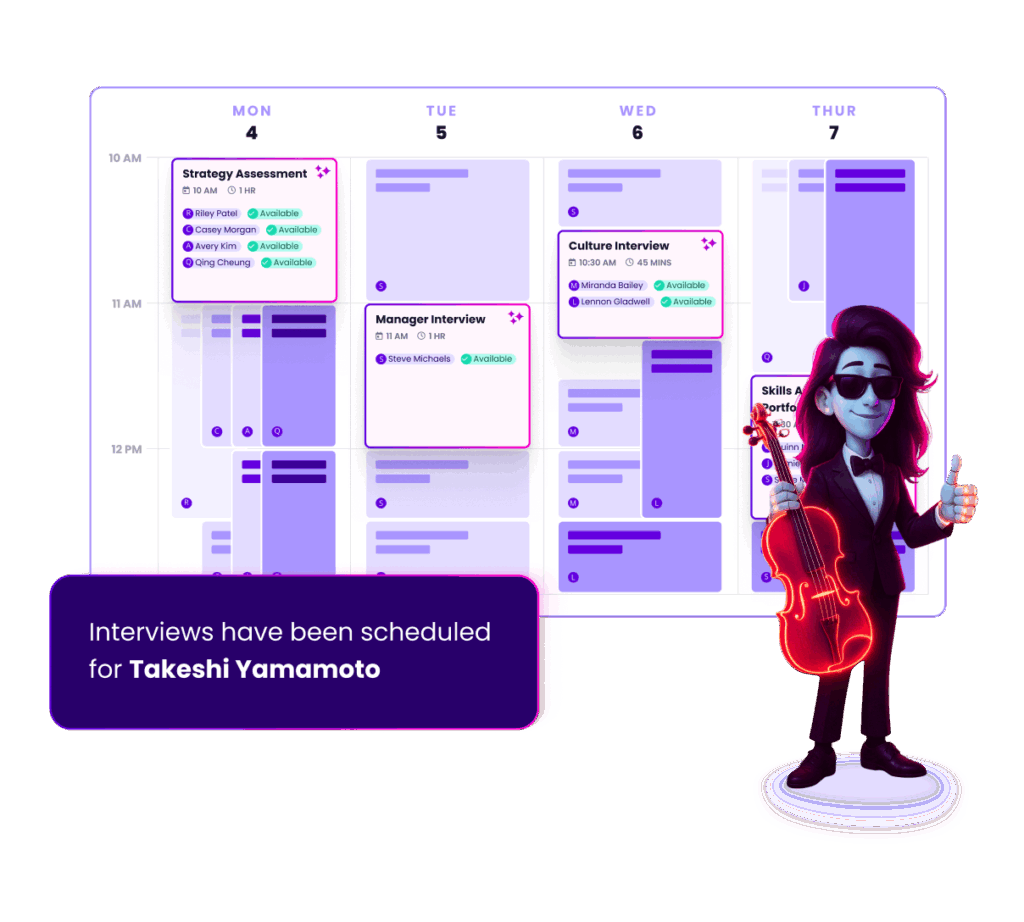

Scheduling remains the top operational burden in hiring

Despite advancements in hiring technology, scheduling remains the single most time-consuming and disruptive part of the process.

Talent teams report spending 38% of their time scheduling interviews, making scheduling the highest operational burden measured. And the ripple effect of scheduling-related bottlenecks shapes nearly every stage of the hiring process.

The most-cited scheduling bottlenecks include:

- Scheduling delays (35%)

- Limited interviewer pool (35%)

- Cancellations/reschedules (32%)

- Hiring manager availability (31%)

These are not isolated inconveniences. They are systemic blockers that lengthen hiring timelines, frustrate candidates, and increase the likelihood of losing talent to faster-moving competitors. Each cancellation can trigger multi-day delays, and each delayed response can push a qualified candidate toward another offer.

“If recruiters are still spending over a third of their time on scheduling, we’re not just missing hiring goals — we’re misusing talent. AI should handle at least 75% of the operational work so TA can focus on what humans do best: building trust, challenging bias, and hiring diverse teams that move the business.”

-Kobi Ampoma, Head of Talent Acquisition (NL), The HEINEKEN Company

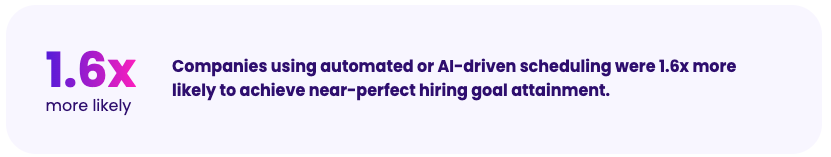

Automated scheduling strongly correlates with higher goal attainment

The data has already made one thing clear: interview scheduling is not a side task, but the ultimate bottleneck. But understanding the problem is only half the equation. The more important question is whether fixing it actually changes outcomes.

This year’s data shows that it does.

Companies using automated or AI-driven scheduling were 1.6x more likely to achieve near-perfect hiring goal attainment (13% hitting 90–100%, compared with 8% of non-users). This marks scheduling automation not just as a time-saver, but as a meaningful operational advantage tied directly to hiring outcomes.

The correlation makes intuitive sense: when coordination delays, back-and-forth rescheduling, and interviewer bottlenecks are reduced, TA teams regain bandwidth to nurture candidates and make timely decisions. In contrast, organizations still relying on manual scheduling are struggling under operational weight that compounds with every requisition.

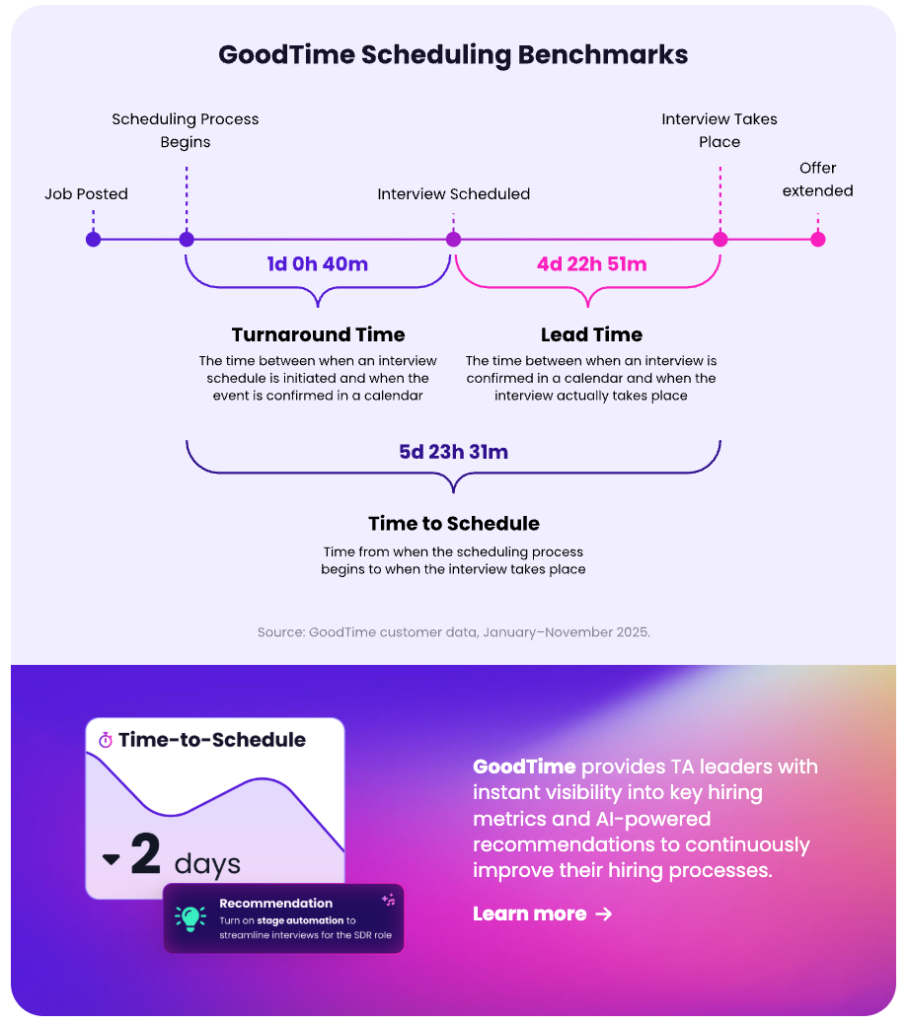

Current scheduling benchmarks

Scheduling speed is one of the clearest operational signals behind time to hire. While time-to-hire captures the outcome, scheduling metrics reveal where momentum is gained or lost—often days before delays show up in aggregate hiring data.

The benchmarks below reflect the three most important scheduling metrics TA teams should monitor to keep hiring moving efficiently.

AI’s role evolves: from basic automation to decision intelligence

AI adoption in talent acquisition reached near-universal levels in 2025, but how teams use AI has changed dramatically.

The top AI use case this year was analytics and reporting, with 45% of teams leveraging AI to surface insights, track funnel health, and identify inefficiencies. Scheduling (36%) and resume screening (36%) remain widely used but no longer dominate the narrative.

This signals a critical shift: AI is becoming the decision-making infrastructure behind hiring, not merely a way to automate repetitive tasks.

TA teams are increasingly relying on AI for:

- Diagnostic visibility into bottlenecks

- High-resolution quality-of-hire signals

- Resource allocation insights

- Predictive performance indicators

In other words, AI is expanding from “doing work” to “informing how work is done.”

“The goal isn’t just speed. It’s to free people to focus on what matters most. Our coordinators can now focus on the interactions that matter — guiding candidates, coaching hiring managers, and refining the experience instead of chasing calendars.”

-Tiffany Clark, Head of HR Strategy & Shared Services, S&P Global

How talent teams changedthis year

Talent teams underwent significant restructuring last year, driven by shifting hiring demands and evolving organizational priorities. More than half of companies (56%) grew their TA headcount, reflecting increased pressure to meet hiring goals and support more complex workflows. Another 24% kept headcount steady but reorganized roles, often redistributing responsibilities to adapt to new tools, expectations, or process requirements. Meanwhile, 19% reported reducing TA headcount, forcing smaller teams to manage the same or greater workload with fewer resources.

AI played an increasingly influential role in these changes. As AI automated scheduling, screening, and reporting tasks, many organizations reevaluated coordinator responsibilities, expanded recruiter support roles, or shifted bandwidth toward candidate experience and strategic partnership activities.

Collectively, these adjustments reflect a larger transition: TA teams are not simply shrinking or growing—they are transforming.

Roles are being redesigned to align with an AI-enabled hiring ecosystem where operational work is streamlined and human expertise is focused on higher-value decision-making and engagement.

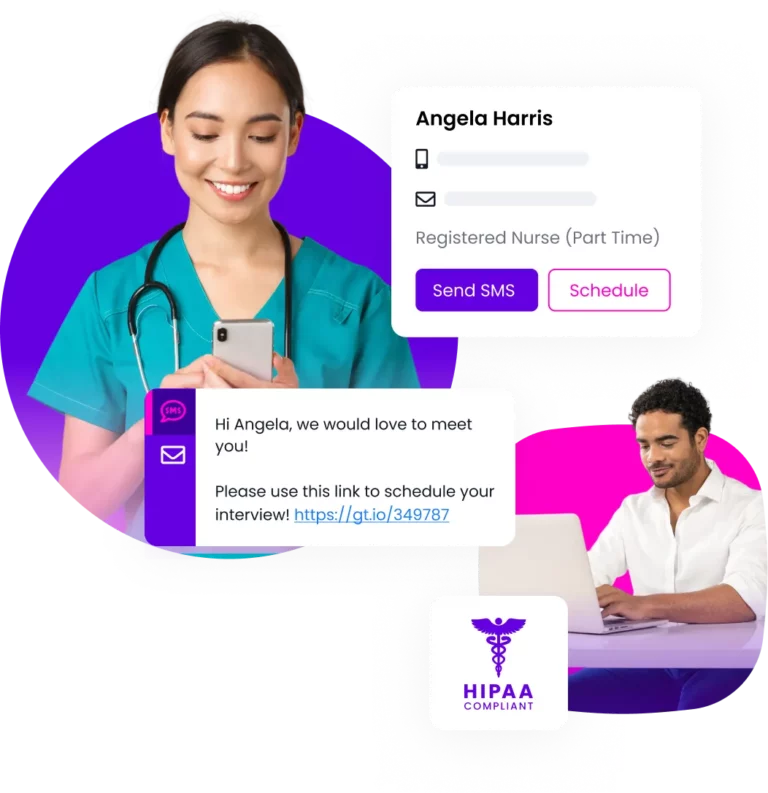

Candidate communication trends: texting becomes central—and centralized

Texting has become a core part of candidate communication, but how teams manage it varies widely. 40% of organizations now use a centralized company platform or texting software, the most common approach and the one most associated with consistency and compliance.

Another 36% text candidates using company-issued phones, while 24% still rely on recruiters’ personal cell phones, introducing risks around tracking, data security, and uneven candidate experience. Notably, 0% of respondents say they avoid SMS or WhatsApp altogether, underscoring how essential mobile communication has become in the hiring process.

More layoffs than we’ve seen in four years

Layoffs surged sharply over the past 12 months, marking one of the most turbulent periods for talent teams in recent years. 75% of companies conducted layoffs in 2025, the highest level in the past four years, and a steep rise from 2024 and 2023. The scale of these reductions signals widespread organizational restructuring and heightened economic uncertainty.

The severity of layoffs also increased. While the majority of organizations kept reductions relatively limited, the distribution reveals escalating pressure across the workforce:

The end of the RTO debate: Office-first becomes the dominant reality

The pendulum has swung decisively. Here’s the current status of workforce distribution:

- 55% fully in office

- 42% mostly in office

- Only 3% mostly remote

- None were fully remote

Despite media narratives about remote stability, the data shows a nearly universal return to office-first operating models.

This shift adds complexity for TA teams who must now navigate redefined candidate expectations, changing geographic recruiting strategies, and evolving internal policies.

A year defined by pressure, and by clarity

2025 exposed deep operational friction across the hiring lifecycle, from scheduling bottlenecks to rising time-to-hire, increasing candidate misrepresentation, and mounting organizational expectations. Yet it also delivered clarity: the organizations making meaningful progress are those that have embraced AI-driven decision-making, standardized workflows, and disciplined process improvement.

The path forward is no longer ambiguous.

To succeed in 2026, talent acquisition must become more efficient, more insight-driven, and more resilient, all while safeguarding authenticity in a rapidly evolving talent landscape.